Yes, payday loans are legal in Canada! The amount you can borrow and how long for depends on the province or the city you live in, but the federal government does have a blanket rule which the whole country follows.

You can apply online to borrow any amount up to $1500 and usually for a maximum of 62 days.

Payday loans are allowed under section 347.1 of the Criminal Code, as long as the provincial laws are followed, and the lender is regulated.

Key Stats

- A payday loan costs $17 per $100 that you borrow, which is the same as an annual interest rate of 442%

- A line of credit includes a $5 administration fee plus 8% annual interest on the amount you borrow

- Overdraft protection on a chequeing account includes a $5 fee plus 21% annual interest on the amount you borrow

- A cash advance on a credit card includes a $5 fee plus 23% annual interest on the amount you borrow

Source: Canada.CA

Where are Payday Loans Legal?

Payday loans are legal across all 10 provinces for people looking for loans in Canada and across all major towns and cities. You can get a payday loan in any of the provinces, including;

| Alberta | New Brunswick | Prince Edward Island |

| British Columbia | Newfoundland and Labrador | Quebec |

| Manitoba | Nova Scotia | Saskatchewan |

| Ontario |

Dime Alley is a fully-online service – we connect you, the borrower, with a panel of lenders. The lender that you are matched with will be the one who best suits your financial needs, giving you a fair rate with good terms.

All our lenders across Canada are licensed, and so whether you are trying to get a payday loan in Ontario, Alberta or Quebec, you can rely on Dime Alley to match you up with a legitimate lender.

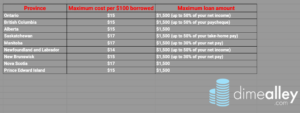

How Much Can I Borrow in Canada?

The amount you can borrow in your Canadian payday loan ultimately depends on the province you live in, and the city or town.

For example, if you live in Toronto, Ontario, your lender must provide a contract including the amount being borrowed, the term of the loan, and the cost of the loan. The lender is not allowed to ask or accept payment by automatic deduction from a borrowers paycheck.

Lenders in Ontario cannot charge the borrower more than $15 for every $100 they borrow and cannot offer or sell any goods or services along with the payday loan. As the borrower, you are allowed to cancel your loan within two business days without having to give a reason.

Why Get a Canadian Loan?

Payday loans in Canada are there to help people out a temporary financial bind. They’re not meant to top up your bank account, because you’re spending more than what you earn.

However, they are a popular financial tool when you know you have money coming in soon, but you need access to cash now. You can often get money the same day as when you apply.

If you find yourself with an emergency bill, or you’ve realised that you don’t have enough in your bank account to pay for essentials to last you until your next payday, then a payday loan in Canada may be right for you.

How To Qualify For a Canada Payday Loan

To be eligible for a Canada loan, you must meet the following basic requirements;

- You need to be a Canadian resident, at least 18 years of age with a permanent address;

- You must have a checking account with a Canadian bank (for your loan to be paid into);

- You must have some form of regular income;

- You must have a valid email and an active cellphone or home telephone number.

Can I Get a Loan in Canada With Bad Credit?

The short answer is yes, you can get a payday loan in Canada, even if you have bad credit.

However, be aware that the worse your credit, the less favorable the rates will be, as lenders are less assured that you will be able to pay back your loan when it is due.

Having said that, don’t let bad credit deter you from applying for a payday loan! The chances are that you will qualify and one of our many lenders will be able to help create a payday loan plan with terms that suit your financial needs.

Will a Canada Payday Loan Impact My Credit Score?

In short, no, getting a payday loan in Canada won’t have an impact on your credit score.

However, if you are late in making your repayments, or struggle to repay at all, this many negatively impact your credit.

When you apply online with Dime Alley, we will only conduct a soft credit search which has no bearing on your credit score!

Also, if you are able to pay off your payday loan on-time and in-full, this can actually help your credit score, as it shows lenders that you are a responsible borrower!