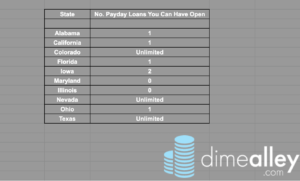

You can get as many payday loans in a year as you like, but in certain states, you can only have one loan outstanding at a time.

However, even in states where you can have more than one payday loan at a time, it is advisable not to take out more than one or two. This is to avoid being overdependent on high cost financial products and potentially falling into a spiral of debt.

In Texas, Nevada and Colorado, there is no cap on the number of payday loans you are allowed to take-out at one time, but even in these states, we advise only to have one or two at the maximum.

How Many Loans Can I Have At Once?

It is advisable to have only one or two outstanding payday loans at one time.

Payday loans are expensive and getting too many can be dangerous – hence why many states enforce regulation capping the number of payday loans you can have out at one time.

There is a good reason why you should not have more than one payday loan open too.

The APR of payday loans is around 400% to 600% which is a very high rate when compared to other financial products such as title loans, mortgages, credit cards, credit unions or personal loans.

Why Shouldn’t You Have More Than One Payday Loan?

Having more than one outstanding payday loan at any one time could make it hard to repay out of your pay cheque each month. Payday loans become dangerous when there are late fees involves and added interest – and this is when the cost of a loan really starts to add up.

Additionally, if you fail to make your repayments on-time and in full, this can negatively impact your credit score, making it harder to access similar loans and other forms of credit in the future – and even some essential things like a cell phone, being able to rent an apartment or get a mortgage.

According to the regulation of each state, it is typically just one loan that you are allowed, such as Florida, Ohio and California.

There are some states where you can have an unlimited number, such as Texas and Nevada, but even in these states, it is advisable not to have more than one or two payday loans out at once.

How Many Payday Loans Can I Have At One Time In Texas?

You can have as many payday loans out in Texas as you wish, however, we advise you take out no more than one or two.

This is because it becomes difficult to keep up with repayments if you have a large number of outstanding loans at any one time. The APR rate in Texas is over 600% which means that payday loans are an expensive, short-term fix, not meant to be a long-term solution to any financial problems.

What Should I Do If I Need More Than One Payday Loan?

If you need more than one or two payday loans at any one time, it is best not to apply for more. Firstly, because most states won’t legally permit you to, but secondly, because they are expensive and could weigh you down financially.

If you need to borrow more money, you could look at closing down your existing payday loan, so paying it off early and then looking for a larger loan amount, whether it is through a credit union which offers much lower rates, using a secured loan or selling every items around the house that you do not use.

You could also consider borrowing money from family and friends, since this is always going to be interest-free and with very loose payment terms. You can simply pay back when you are up to date with your other expenses and feel that you are back on your feet.

Otherwise, you can look into budgeting more carefully, using budgeting apps or keeping better track of your finances. There are a number of simple ways to save money around the house and avoid using high cost loans instead, such as sharing a car with your partner, buying second hand clothing or shopping at cheaper grocery stores.