Being a homeowner is a status that many young Americans aspire to and work towards. It is often why we save, and why we get up to go to work in the mornings.

However, for those of you who are already homeowners, you will now be very much aware that the cost of buying a home isn’t where the expenses end. Running a household in the US incurs costs year after year, and these are costs that rise if you decide to have a family.

It was estimated in 2017 that the cost of running a home, regardless if you own or rent, came to around $19,885 . This breaks down to about $1,657 per month and includes repairs to the dwelling as well as the cost of insurance and taxes.

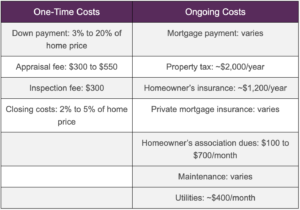

So, what does the $1,657 per month actually go towards?

How To Run a House: Costs of Running

Homeowners Insurance

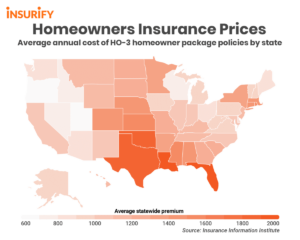

Another consideration to have when running a home is the cost of homeowners insurance, which can vary depending on the state you reside in.

The average homeowners insurance premium in the United States is $1,272 a year. Your home’s value, location, and coverage amount all impact the price you pay. Adding safety features, bundling your policies, and raising your deductible can lower your premiums.

Oklahoma, Kansas, Florida, Arkansas, Texas and Mississippi are the most expensive states for home insurance among common coverage levels. Among the least expensive states for home insurance are Hawaii and Vermont.

The above map indicates the variation in cost of homeowners insurance by state. The darker the shade of orange, the higher the premiums on homeowners insurance.

Property Taxes

Each year, you’ll have to pay property taxes on your home. Property taxes can vary widely depending on where your home is located.

The average property tax on a $250,000 home ranges from a low of $675 in Hawaii to a high of $6,000 in New Jersey.

If you have a mortgage, your property taxes are generally paid in monthly installments to your lender. The lender will put the funds in escrow and pay your entire property tax bill on your behalf before it is due.

Utilities

Most people who have an apartment paying monthly rent are used to paying certain utilities, particularly electricity, cable, and internet.

When you buy a home, however, you have a monthly cost for some utilities that you aren’t used to paying. Water is often included with rental properties, as are sewer and garbage collection expenses.

It is important to be wary of these costs as a homeowner. There are some easy ways which we advise for you to save on your energy bills.

Maintenance Costs

Lastly, bear in mind that your home will need maintenance over time, and if you’ve been a renter, maintenance has probably been your landlord’s responsibility. Home maintenance expenses can range from minor costs like replacing your air filters to major costs like replacing your roof.

As a general rule, it’s a good estimate to expect maintenance expenses to be about 1% of your home’s value per year (so, $2,000 on a $200,000 home). This can vary significantly from year-to-year and can be much greater for older homes.