A cash advance, in simple terms, is a short-term loan to help you cover your living costs. Cash advances are typically used when a customer is in need of money and can’t quite wait until their next payday.

The term, cash advance, could also be referring to a short-term loan provided via your credit card as a cardholder.

A cash advance removes the stress of a regimented pay day, and means that when you need a helping hand, you can find it after curating a plan agreed upon by both you and your lender.

Key Points about Cash Advance Loans

- Cash advances are a common short-term loan used to help tide the borrower over until his or her next payday.

- Cash advance loans are often seen as a better option than a payday loan or a car title loan.

- One common type of cash advance comes in the form of a payday advance, whereby your employer can offer you a percentage of your wages before payday if need be.

How Does a Cash Advance Loan Work?

The process of obtaining a cash advance loan is one of the quickest ways of getting money to tide you over to your next payday.

To obtain a payday loan, you must firstly write a postdated check made out to the payday lender for the amount you plan to borrow, including the fees. The lender will then immediately issue you the borrowed amount, but will wait to cash your check until the payday arrives.

Some online lenders now have borrowers sign an agreement for automatic repayment from their bank accounts, often in the form of an ACH authorization. Lenders usually ask that you provide personal identification and proof of income when you apply.

Some employers offer payday loans or advances on pay checks as a service to their employees. Terms vary, but often no fees or interest are charged.

How much can you typically borrow with a Cash Advance Loan?

Issued by payday lenders, loans can range anywhere from $100 to $35,000, but are most commonly issued for amounts in the region of $100-$1,000.

However, it is important to bear in mind that cash advance loans do come with fees (around $15 per $100 borrowed – or even more in some cases) and interest rates which can exceed 100%, depending on your lender and your creditworthiness.

Rather than taking into account the borrower’s credit score, the lender will more commonly determine the repayment terms of your loan based on local state regulations and the size of the applicant’s paycheck. If the loan is approved, the lender hands the borrower cash; if the transaction takes place online, the lender makes an electronic deposit to the borrower’s checking or savings account.

The loans are extremely short term – they must be paid back on the borrower’s next payday unless they wish to extend the loan, and in that case, additional interest is charged.

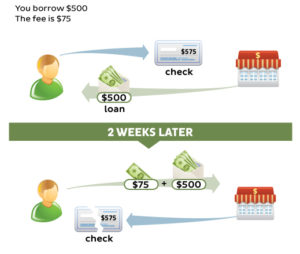

Cash Advance Loan: a working example

In the example detailed above, if you decide to borrow $500, and the interest the lender decided to charge is 15%, the fee is $75. Therefore, you give your lender a check for $575. The lender will keep your check and give you $500 in cash. Consider this to be your loan.

After two weeks, you are obligated to give your lender $575 back in cash, and you’ll get your check back. The bottom line here is that you will have paid $75 to borrow $500 for two weeks.

Most loans have an annual percentage rate, abbreviated as the APR. The APR is how much it costs you to borrow money for one year. The APR on cash advances is typically quite high. When you get a payday loan or cash advance loan, the lender must tell you the APR and the cost of the loan.

What are the Pros and Cons of Cash Advance Loans?

Pros

- A cash advance loan could be a reasonable option for someone who has an emergency need for money and limited resources for getting it, especially when that person has a clear and reasonable plan for paying back the money in a short period.

- Cash advance loans are often seen as a better option than a payday loan or a car title loan, due to the extremely high interest rates that those loans typically carry and the greater payoff flexibility that comes with credit card debt.

Cons

- It is important that you aren’t using your cash advance loan to pay-off debt. A cash advance is a very expensive way to pay bills, and the risk of falling into revolving debt cannot be ignored.

- The potential to pay many times the amount of the original advance (in interest charges) is very real.

- In addition to higher interest rates, there are often additional fees attached to cash advance loans.