An installment loan is a type of loan where you borrow a set amount of money all at one time. You are then obligated to repay your loan over a fixed number of payments, which are known as installments.

The term, “installment loan” is actually more of a general term which refers to the overwhelming majority of personal and commercial loans extended to borrowers. Installment loans can actually include any loan that is repaid with regularly scheduled payments or installments.

Many installment loans also have fixed payment amounts, meaning the amount doesn’t change over the life of the loan — whereas if you have a variable interest rate that amount can change. These types of loans can also be secured with collateral, like a car, or come as unsecured loans, but this will often lead to a higher interest rate.

Secured or Unsecured Installment Loan Meaning

Installment loans may be either secured or unsecured.

Unsecured Installment Loans

Some installment loans are offered by lenders without collateral being required. These often take the form of personal loans.

Loans that are offered without the requirement of collateral, which can include a vehicle, your home or your savings account, are made based on the borrower’s creditworthiness. The borrower’s creditworthiness is usually shown through your credit score, and the ability to repay as shown by the borrower’s income and assets.

The interest rate charged on an unsecured loan is usually higher than the rate that would be charged on a secured loan, reflecting the higher risk of non-repayment that the creditor accepts.

Secured Installment Loans

A secured installment loan requires collateral—someone’s asset or property—as security against the loan.

The lender can take ownership of a loan’s collateral if you fail to pay, meaning that if you can’t repay your auto loan, for instance, the lender can repossess your car.

Types of Installment Loans

Personal Loans

Personal loans are installment loans you can use for almost any reason. Available loan amounts range from $1,000 to $100,000, and repayment terms are typically two to seven years.

A lender decides whether you qualify for a personal loan and at what rate using information like your credit history and score, income and other outstanding debts.

Unsecured personal loans are more common than secured personal loans, but some lenders let borrowers use a savings or investment account or a vehicle as collateral for the loan to potentially qualify for a lower rate.

Auto Loans

Auto loans are typically repaid in monthly installments over a range of 12 to 96 months, although not all lenders issue loans with terms within that range.

Loans with longer terms often come with lower monthly payments, and higher interest rates, too.

This means you’ll end up paying more overall to buy a car with an 84-month loan, even if your monthly payments are lower, than with a 36-month loan.

Student Loans

Student loans are installment loans because you pay them back in regular payments over time.

They can have fixed or variable rates, though, and often include a period after you’ve borrowed the money when interest accumulates but monthly payments haven’t kicked in.

Mortgages

A mortgage is an installment loan used to borrow money to buy a house. Mortgages are typically repaid over 15-to-30-year terms with monthly payments.

Some mortgages come with fixed interest rates that typically don’t change. This means the standard monthly principal and interest payments won’t change, either.

What is a non-Mortgage Installment Loan?

A non-mortgage installment loan is one that is paid in installments of a period of time.

Under this umbrella, you can also get loans that permit the borrower to make irregular payments and to borrow additional funds without submitting a new credit application; also known as revolving or open-end credit.

Cost Example of an Installment Loan

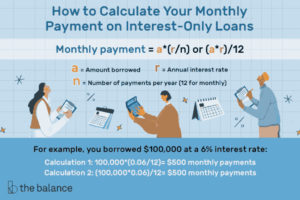

Using an example figure of $100,000 at an interest rate of 6%, your calculation would look like this:

$100,000 (the amount of the loan) x 0.06 (6% expressed as 0.06) / 12 (based on 12 monthly payments)

( 100,000 * 0.06 ) / 12 = 500

Therefore, for an installment loan of $100,000 to be paid-back with a 6% interest rate, your monthly payments would be $500 per month on top of the $100,000 you initially borrowed.

Installment Loans: Pros and Cons

Pros

- For the majority, Installment loans will come with predictable payments. If you take out a fixed-interest-rate loan, the core components of your payment will likely remain the same every month until you pay off your loan.

- Predictable repayments will make it easier to budget for your loan payment each month, helping you avoid missing any payments because of unexpected changes to the amount you owe.

- When shopping for an installment loan, make sure the monthly payments won’t stretch your budget.

- Installment loans also offer the comfort of knowing your debt can be paid off by a specified date. After you’re done paying the number of installments required by the loan, your debt should be paid off in full.

- If you get a loan with the shortest payment term you can reasonably afford, you can get out of debt faster and will probably pay less interest.

Cons

- Once you take out the loan, you can’t add to the amount you need to borrow, like you can with a credit card or line of credit. Instead, you’ll have to take out a new loan to borrow more money.

- Your interest rate and loan terms are usually based on your credit. If you’ve struggled with credit in the past and don’t have a great credit score, the chances are you’ll have to pay a higher interest rate than borrowers with strong credit histories.

- Higher interest rates result in larger monthly payments and a higher total cost of borrowing.

- Installment loans could come with other fees and penalties. Some lenders require you to pay application fees and credit check fees, which increase your total cost up-front.

- Installment lenders may also charge prepayment penalties, which require you to pay a fee when paying the loan off early.