Debt consolidation is a form of debt relief which essentially involves taking multiple debt payments, which could include credit card debt, debt from short-term loans, or even student debt, and rolling them into one single repayment.

Typically, you would take a high-interest product like a credit card or multiple credit cards, and refinance it so that you just have one monthly payment. This helps you organize your debt and also lowers your total monthly repayments.

Whilst debt consolidation could provide added convenience and potentially even get you a better interest rate on your repayment, ultimately, consolidating your debts into a single loan may streamline your finances, but the strategy likely won’t fix underlying financial challenges.

How To Consolidate Your Debt With a Loan

1. Work out what you owe.

Look at your existing credit card, loan and overdraft debts. Calculate the total value of the loan you’ll need to cover these existing debts and apply for a debt consolidation loan to borrow that amount.

3. Pay-off your debt with the loan.

Use the loan to pay off existing borrowing. Having just one loan reduces the amount of repayments you have to make each month by having your debt in one place

Pros and Cons of Debt Consolidation

Pros

1. Streamlines your finances.

Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to worry about.

Consolidation can also improve your credit by reducing the chances of making a late payment—or missing a payment entirely. And, if you’re working toward a debt-free lifestyle, you’ll have a better idea of when all of your debt will be paid off.

2. Helps you pay-off earlier.

If your debt consolidation loan is accruing less interest than the individual loans would, consider making extra payments with the money you save each month. This can help you pay off the debt earlier, thereby saving even more on interest in the long run.

Keep in mind, however, that debt consolidation typically leads to more extended loan terms—so you’ll have to make a point of paying your debt off early to take advantage of this benefit.

3. Could lead to a lower interest rate.

If your credit score has improved since applying for other loans, you may be able to decrease your overall interest rate by consolidating debts—even if you have mostly low-interest loans.

Doing so can save you money over the life of the loan, especially if you don’t consolidate with a long loan term.

Cons

1. May come with added costs.

Taking out a debt consolidation loan may involve additional fees like origination fees, balance transfer fees, closing costs and annual fees.

When shopping for a lender, make sure you understand the true cost of each debt consolidation loan before signing on the dotted line.

2. You could end up paying more interest over time.

Even if your interest rate goes down when consolidating, you could still pay more in interest over the life of the new loan.

When you consolidate debt, the repayment timeline starts from day one and may extend as long as seven years. Your overall monthly payment may be lower than you’re used to, but interest will accrue for a longer period of time.

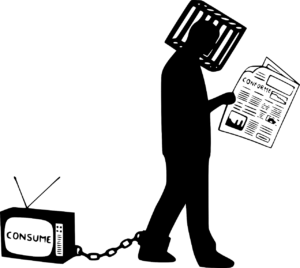

3. It won’t solve underlying financial issues.

Consolidating debt can simplify payments but it doesn’t address any underlying financial habits that led to those debts in the first place.

In fact, many borrowers who take advantage of debt consolidation find themselves in deeper debt because they didn’t curb their spending and continued to build debt.

Consolidate Debt With a 0% Interest Credit Card

- You would take all of your debt and transfer it onto this credit card.

- Pay off the entire amount owed in the ‘promotional period’ so that you don’t get any interest.

If you have a credit score of over 690 then you will probably be eligible for one of these cards.