Debt Management, Debt Relief or Debt Consolidation is simply a way to get your debt under control through financial planning and budgeting.

The aim of a debt management plan is to use certain strategies to help you lower your current debt and move toward eliminating it.

Debt Management plans are most suitable for those either in a spiral of debt, with several outstanding loans or credit card debt bills or for those on the verge or in a state of bankruptcy.

What is Debt Management?

Debt management, debt relief or debt consolidation companies are able to take your existing debts and provide a plan to help you pay them off.

According to recent statistics, the total personal debt in the U.S. is at an all-time high of $14.96 trillion. The average American debt (per U.S. adult) is $58,604 and 77% of American households have at least some type of debt. (Source NewYorkFed)

The goal of a debt management plan is to use certain strategies to help you lower your current debt and move toward eliminating it. You can create a debt management plan for yourself or go through credit counselling to help you with your plan.

How Does Debt Management Work?

Debt management plans usually address unsecured debts like credit cards and personal loans.

You might approach a debt relief company or they might approach you. You may even find that if you apply for a loan for bad credit or credit card and are not successful (may be due a poor credit score), you may be recommended to a debt management firm.

The Debt Management company will start by reviewing all your outstanding debts and create a debt consolidation plan, putting all your debt into one loan which you will pay off into one account every month. So this saves you having to contact every lender one by one and pay them each individually every week or month.

The debt company will usually negotiate a pay plan with your lenders and ask them to freeze the interest. So that instead of having to pay off the outstanding amount like $100 or $200, you can pay back $5 every week or month and over time, this will clear your debt.

You will need to ensure that you still have an income every week to pay off the debt consolidation loan – where most of your income will go towards paying off your arrears and the rest will be calculated and apportioned for your food, rent, entertainment and other necessities like clothes.

The company will add a bit extra to your monthly payment and this will be their fee for ‘managing your debt.’

DIY Debt Management

If you decide to take your debt management plan upon yourself, this will usually involve creating a budget for yourself that will allow you to pay off your debts and maintain your financial stability. The debt snowball or debt avalanche methods are DIY versions of debt management.

You can use budget calculators, repayment calculators and financial management apps to help keep you on track. If need be, you can also do some negotiating with your creditors to try and lower your monthly payments or interest rates to help you decrease your debt.

Once the debt is under control, you can decide if you want to keep or close an account.

When Should I Use a Debt Management Plan?

If you’re struggling with revolving debt, the upsides are:

- A single, lower payment;

- No more (or at least fewer) phone calls from creditors or collectors;

- The ability to finally put debt behind you.

It’s probably not right for you if:

- You are having trouble paying secured debts, such as a mortgage or car payment;

- Your income barely covers necessities, such as food and utilities;

- You want to continue to use your credit cards.

Having to live without credit cards or new credit might be an advantage if you worry about controlling spending.

Because you have to commit to many months of payments, you’ll want to make sure there is room in your budget to do so. Over the years you’re paying the plan, unexpected expenses will crop up, so access to some kind of emergency fund is crucial. See emergency same day cash for more information.

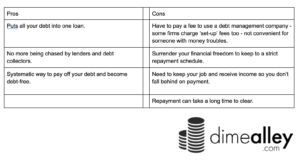

Pros and Cons of Debt Management Plans

Does Debt Management Affect Your Credit Score?

While debt management can be a helpful tool to get debt under control, it can negatively affect your credit score.

Hard Credit Checks

A hard search may happen at some points in debt management. For example, if you attempt to get a lower interest rate, you may trigger a hard search into your credit report. Hard searches stay on your credit report for two years and can impact your credit score for one year.

However, this is a short-term effect and can easily be countered by other factors. For example, if you can get your rate lowered, and this means you’re able to pay your monthly bill consistently, you’ll see a positive effect on your payment history which can raise your credit score.

Missed Payments

Making consistent payments will positively affect payment history, however, missing payments will cause your credit score to lower significantly. If your debt management company are using a tactic of withholding payment from your creditor to get a better rate, expect your credit score to go down.