Dime Alley’s lenders in Wisconsin offer payday loans, installment loans and cash advances, depending on your needs as a borrower.

You can get an installment loan or payday loan in Wisconsin no matter which city or town you live in, including Milwaukee, Madison and Green Bay.

Apply online for a Wisconsin WI loan and receive the funds into your account within 24 hours of applying.

Can I Get an Installment Loan in Wisconsin?

Yes, you can get an installment loan in Wisconsin with Dime Alley!

Installment loans are designed to be short-term loans and are most commonly used to cover an unexpected bill or expense, or to tide you over to your next payday.

They are different to traditional payday loans as your loan will be transferred into your checking account in installments, rather than as one lump sum.

You can get an installment loan in Wisconsin for anywhere between $100 to $1500 for 6, 9 or 12 months with payments to be made on an agreed-upon day each month.

Am I Eligible For a Payday Loan in Wisconsin?

In order to qualify for a payday loan in Wisconsin, there are a few simple criteria that to meet to have a chance at being approved.

- You must be a US resident

- Over the age of 18.

- You should have a stable, regular income, earning a minimum of $800 per month.

- You should have a valid mobile phone account and a live checking account (for your loan to be deposited into).

Rules and Regulations for Wisconsin WI Loans

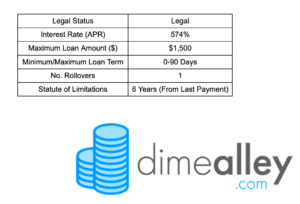

Wisconsin has no limit to either the amount of a payday loan or its interest. However, a total amount of outstanding loans should not exceed $1,500 or 35% of the customer’s gross monthly income, whichever is less.

2 renewals are allowed, there is no limit to the number of loans but for the condition of a 24-hour cooling-off period between them. NSF fee should not exceed $15 in the state; criminal actions are prohibited.

Can I Get a Payday Loan in Milwaukee with Bad Credit?

Our lenders in Milwaukee and Madison, Wisconsin WI take all credit histories into account, and can provide you with fast cash no matter what your credit score is – good or bad!

In fact, if you repay your loan on-time and in full, this may even help your credit score, as creditors and future lenders will be able to see that you’re responsible with your finances.

As long as you meet the basic eligibility requirements (listed above) then feel free to apply – our panel of lenders take a wide range of applications and no matter your credit score, Dime Alley can help you find an installment loan, payday loan or cash advance in Wisconsin WI that suits your needs.

Where in Wisconsin Can I Get a Loan?

You could get a Payday Loan, Installment Loan or Cash Advance in any city or town in Wisconsin WI! Here are some examples of cities that offer Wisconsin Loans – and there are more too! If you don’t see your city on this list then don’t be alarmed – we offer loans wherever you are!

- Milwaukee

- Madison

- Green Bay

- Kenosha

- Racine

- Appleton

- Waukesha city

- Eau Claire

- Oshkosh

- Janesville

- West Allis

- La Crosse

- Sheboygan

- Wauwatosa

- Fond du Lac

- Brookfield

- New Berlin

- Wausau

- Menomonee Falls

- Greenfield

- Franklin

- Beloit

- Oak Creek

- Sun Prairie

- Manitowoc

- West Bend

- Fitchburg

- Mount Pleasant

- Neenah

- Superior city

- Stevens Point

- Caledonia

- De Pere

- Muskego

- Mequon

- Watertown

- Middleton

- Pleasant Prairie

- South Milwaukee

- Germantown

- Howard

- Fox Crossing

- Onalaska

- Wisconsin Rapids

- Marshfield

- Cudahy

- Menasha

- Oconomowoc

- Ashwaubenon

- Kaukauna

Which Other US States Offer Payday Loans or Installment Loans?

You could borrow money by applying online for a payday loan or installment loan in any of 37 states across America! Some of these include Wisconsin, California, Texas, Alabama, Nevada, Ohio and Kentucky – and more!

However, it is important to note that payday lending, both online and in-store, are currently illegal in 13 states, such as Arizona, New Jersey, New York and West Virginia.