Loans For People Who Have Retired

Dime Alley can help you secure a Loan if you’re Retired of $800, $1000 or $1500 today! Our application is quick and easy and will only take 5 minutes of your time. Get a loan with Dime Alley to help stretch your pension fund a little further!

How Can I Get a Loan for Pensioners?

Getting a loan for retirees with us is easy thanks to our 3-step process:

Where Can I Find Loans for Retired People Near Me?

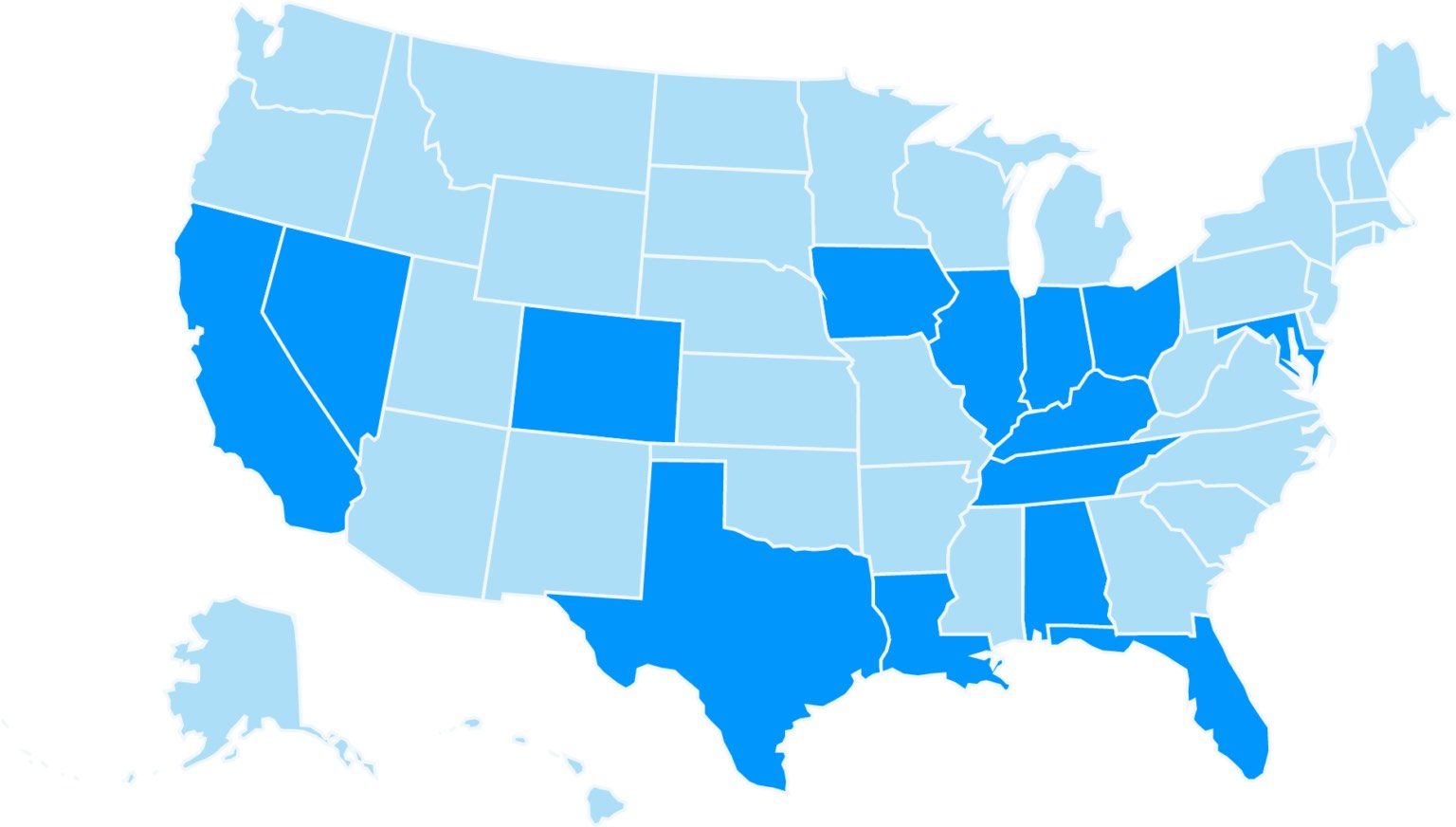

We provide loans in all of the 37 states which approve payday loans. These include California, Texas and Nevada.

In some of the states we operate in, we are limited by legislation on how much we can lend. In some states, the interest on loans are limited, such as in South Dakota.

We don’t operate in the states where payday loans are not authorized, such as New York.

Why Use Loans for Retired People From Dime Alley?

Convenient: One of the main benefits of applying for a loan online is that you can do it from the comfort of your own home.

Privacy: Another reason to apply for a loan online is because you don’t have to speak to anybody face-to-face about your financial situation.

Shorter process: Applying in-store will generally take a lot longer. As well as having to visit various lenders to find the best loan for you, you may also have to wait days, or even weeks for an initial appointment.

Where Can I

Borrow Money Near Me?

We proudly operate in the following US states:

Can I Get a Retirement Loan with Bad Credit?

You don’t need perfect credit to apply for an OAP loan with Dime Alley!

Our trusted panel of lenders lend to borrowers with all kinds of financial records. They aim to provide you with the best available rates to you and help you where they can.

We know that it can be stressful securing a loan when your credit history is imperfect, which is why we consider all applications. We try to make stressful times that bit less daunting.

In fact, if you borrow $600, $800 or $1500 and pay it off according to the terms of your agreement, your credit history could be improved. This can make it easier to secure loans in the future should you need them.

How Fast Can I Receive My Pensioner Loan?

You could have your retirement loan in your account the very same day you apply for it.

When we receive your application, we connect it with one of our regulated lenders who we deem a good fit for you.

We aim to find you a match within 24 hours.

How Do I Repay a Loan For Retired People?

Repayments on your retirement loan will be withdrawn from your checking account on the same day every month until you have paid off the loan and accompanying interest. You and your lender will agree on this date together, but most opt to choose their pay day.

Payments are made in equal amounts and you have the ability to pay your loan off early if you can. However, you should be clear on the repayment terms before deciding to alter your repayment plan.

What People Say About Us

“Personal and friendly, they did what they said they would do, I was approved for a loan although I have bad credit. It was just a short term thing, but has helped me and my family.”

Merryl, Texas, September 2021

“I found the experience overall easy to use. I had to sign an agreement online and all the terms were there and very clear. I would do it again if I needed some money.”

Imani, Georgia, March 2021

“I need a loan to pay back a friend and it was all very quick and easy to get a couple of hundred bucks which I repaid over a couple of weeks.”

Malik, California, December 2022

More Frequently Asked Questions

How Much Will I Pay for a Retirement Loan?

There are price caps of around 300% to 600% APR depending on the state, but where payday loans are not legal, it is capped strictly at 36% APR maximum.

A payday loans interest cap is a limit on how much interest lenders are allowed to charge borrowers for taking out a payday loan.

Was this helpful?

Can I Get a Loan for Retirees with No Credit Check?

Dime Alley will consider those looking for no credit check loans, but note that a credit check is usually carried out for all customers.

However, when you apply, this will not impact your credit score as we only conduct a soft search.

Was this helpful?

Is Dime Alley a Broker?

Yes! Dime Alley is a broker, meaning that if you’re approved, we don’t provide the funds for your loan directly. Instead, we connect you to a lender best suited to your situation from our trusted panel.

Do not worry though, your information is completely secure and will not be sent or shared with any other companies or third parties and we certainly will not charge you anything for using our service.

Was this helpful?

How Much Can I Borrow as a Retiree?

With Dime Alley, you could get a loan from $100 to $35,000 – with the amount you can borrow based on factors like your monthly income, credit status and affordability.

Other things come into play too, including your residence (homeowners are often preferred), age and whether you have any other similar loans open too.

Was this helpful?

What is the Repayment Period on my Retirement Loan?

Customers can repay over 1 month to 60 months (or equal to 5 years) – this will depend on whether you prefer the payday option which may be just a few weeks or months, or the longer installment option which can be several years to stretch out your repayments.

Payments are usually made in equal monthly installments from the bank account you choose and you always have the option to repay early if you would like to do so.

Was this helpful?

Am I Eligible for a Retirement Loan?

You can apply for a pensioners loan with us as long as you meet these following four requirements;

- Are over 18 years of age

- Have American citizenship

- Have a minimum monthly income of $800

- Have a current account for us to deposit funds into

Was this helpful?