Unemployment Loans With Dime Alley – Borrow Online – Bad Credit Accepted!

Apply Online Today with Same Day Decision!

Dime Alley offers different loans for unemployed people, even without perfect credit! Borrow $600, $800 or $1500 to help with bills until your next payday. Our online application is quick, easy and doesn’t leave a footprint on your credit score.

Unemployed Loans – Our 3-Step Process:

Am I Eligible for a Loan for Unemployment?

You can apply for an unemployed loan with us as long as you meet these following four requirements;

- Are over 18 years of age;

- Have American citizenship;

- Have a minimum monthly income of $800 – this can be in the form of unemployment or other benefits;

- Have a current account for us to deposit funds into.

Recent Guides

How Fast Can I Receive My Unemployment Loan?

You could have the loan for unemployed people in your account the very same day you apply for it.

When we receive your application, we connect it with one of our regulated lenders who we deem a good fit for you.

We aim to find you a match within 24 hours, and our repayment plans are of your choosing, agreed upon with your lender, and can last anywhere from 1 to 60 months (or 5 years).

Where Can I Get an Unemployed Loan?

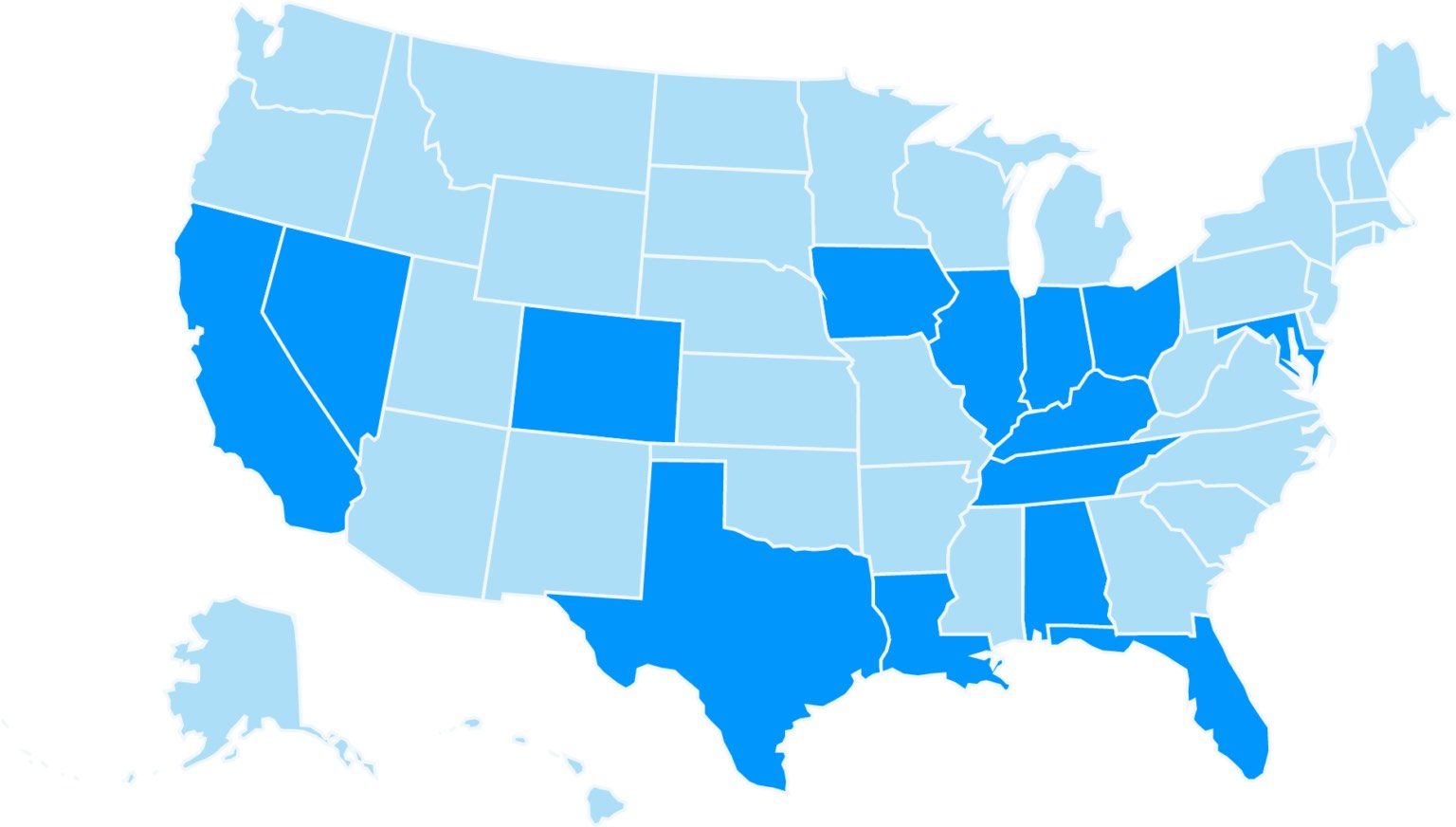

We provide loans in all of the 37 states which approve payday loans. These include California, Texas and Nevada.

In some of the states we operate in, we are limited by legislation on how much we can lend. In some states, the interest on loans are limited, such as in South Dakota.

We don’t operate in the states where payday loans are not authorized, such as New York.

Where Can I Borrow Money Near Me?

We proudly operate in the following US states:

Can I Apply For an Unemployment Loan with Bad Credit?

You can apply for a loan for unemployment even without perfect credit!

Our trusted panel of lenders lend to borrowers with all kinds of financial records. They aim to provide you with the best available rates to you and help you where they can.

We know that it can be stressful securing a loan when your credit history is imperfect, which is why we consider all applications. We try to make stressful times that bit less daunting.

In fact, if you borrow $800, $1000 and $1500, and pay it off according to the terms of your agreement, your credit history could be improved.

Dime Alley’s Guarantee:

What Do I Need To Consider When Applying To Borrow $1,500 For Unemployment With Dime Alley?

Before applying for a $1,500 loan for unemployment with Dime Alley, you should consider the following:

Whether you urgently need the loan, how you will pay it back, and what will happen if you fail to.

Your credit record will determine the terms you are offered on your loan. The stronger your credit history, the lower interest you are likely to be offered.

Whether you could seek the funds elsewhere, such as from friends and family.

What People Say About Us

“Personal and friendly, they did what they said they would do, I was approved for a loan although I have bad credit. It was just a short term thing, but has helped me and my family.”

Merryl, Texas, September 2021

“I found Dime Alley on Google and applied in a few minutes. I got an instant decision and approved on the same day and was able to pay to have my car repaired immediately. I paid back the loan in 2 weeks and was sorted.”

Bob, Florida, July, 2021

“I found the experience overall easy to use. I had to sign an agreement online and all the terms were there and very clear. I would do it again if I needed some money.”

Imani, Georgia, March 2021

FAQs

Do I Need Perfect Credit for an Unemployment Loan?

If you have a bad credit score, don’t worry – you can still get a loan with Dime Alley.

Our lenders work with a clientele with a variety of credit histories. This means that you should still request a payday loan with us even if you have already been turned down by a bank because of bad credit.

Was this helpful?

How Much Can I Borrow?

With Dime Alley, you could find loans ranging from $100 to $35,000 – with the amount you can borrow based on factors like your monthly income, credit status and affordability.

Other things come into play too, including your residence (homeowners are often preferred), age and whether you have any other similar loans open too.

Was this helpful?

How Does Repayment Work on My Loan?

Customers can repay over 1 month to 60 months (or equal to 5 years) – this will depend on whether you prefer the payday option which may be just a few weeks or months, or the longer installment option which can be several years to stretch out your repayments.

Payments are usually made in equal monthly installments from the bank account you choose and you always have the option to repay early if you would like to do so.

Was this helpful?

Which States Offer Unemployment Loans?

Dime Alley offers loans in all 37 states where payday loans are a legal practice. These include California, Texas and Nevada, and cities such as Dallas and Las Vegas.

States that currently forbid payday loans include Maryland, New Jersey, New York and Massachusetts.

Was this helpful?

Can I Get a Payday Loan With No Credit Check?

Dime Alley will consider those looking for no credit check loans, but note that a credit check is usually carried out for all customers.

Was this helpful?

What are the Regulations in My State?

Each state has different regulations on loans, so there is no blanket answer for all states.

However, some states have stricter regulation than others. For instance, states such as Colorado and Illinois cap interest at 36%, and other states forbid you from having 2 or more loans out at once.

Was this helpful?