Payday Advance Loans

Payday Advance Loans - Apply Now with Dime Alley Today - Borrow Online $500, $800 Dollars or $2000 - Repay When Your Paycheck Comes In!

A Payday Advance can help you borrow $100 dollars to $35,000 until your next payday from work. Dime Alley can offer money upfront to pay for any bills or emergencies and the flexibility to repay over 1 to 60 months. With bad credit and no credit check options too, you can check your eligibility by applying with Dime Alley today!

3 Simple Steps To Get a Payday Advance Loan

Apply for a Payday Advance with Dime Alley

Simply complete our online application form, which takes less than 5 minutes, and you can receive an instant decision on the screen. We only require a few basic details from you, such as your loan amount, your income, employment, residence and monthly expenses.

Subject to further checks, if your loan is approved, it can be funded to your bank account within 1 hour, the same day or next business day.

What is a Payday Advance?

A payday advance refers to an advance on your monthly income and rather than waiting until your next payday from work, you can receive the money upfront.

Also known as a payday advance, this type of loan is designed to help you pay for any pressing or immediate expenses, so you can receive the money in one lump sum upfront to pay off your expense and then repay the loan in full on your next payday from work.

Some advances last just a few weeks, but some can last a few months, giving you the option to repay over monthly installments.

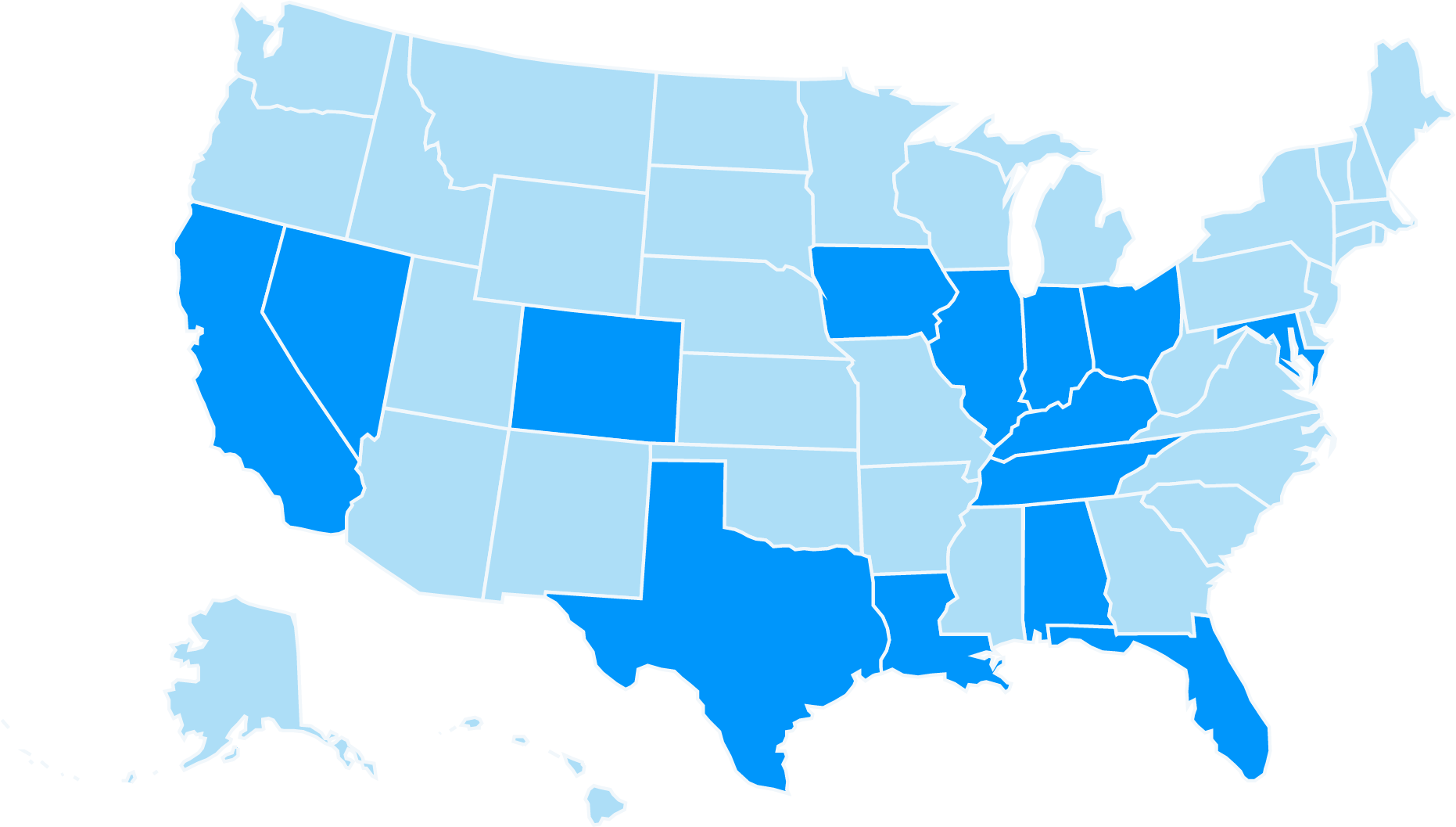

Where Can I Borrow Money Near Me?

We proudly operate in the following US states:

Does Dime Alley Offer Payday Advances for Bad Credit?

Yes, if you are looking for payday advances for bad credit histories, this is something that we can help with. We work with a number of US lenders and many of them are willing to take a view on poor credit histories.

We appreciate that not everyone can have a perfect credit score and there are options available if you have fair or bad credit. Perhaps we can slightly adjust the amount you have requested to borrow or the rate charged will be a little higher.

If you have a regular income and stable employment, you can certainly be eligible for the loan you need. In some cases, we may just require proof of income, just to ensure that you can repay your loan without falling into financial difficulty.

Can I Get a Payday Advance with No Credit Checks?

Yes, it is possible to get a payday advance without credit checks – but most US lenders will carry out a credit check to confirm your eligibility.

It is possible to get loans with no credit checks, such as applying with a credit union or borrowing from family and friends. Or you can consider using secured loans or title loans that use your car or home as collateral – where your eligibility is based on the value of your collateral, rather than your credit score.

But even if you are trying to avoid credit checks for the fear of being declined – do not worry. The lenders that work with Dime Alley are able to take a view on different credit histories, with a number of them specialising in bad credit. Provided that you have a stable employment, regular income and can afford monthly repayments, you can certainly get the loan you need.

How Can I Get a Fast Payday Advance Loan?

Payday advances are available on the same day, especially for smaller amounts of $100 or $200. If you pass the criteria and have applied during working hours of 9AM to 5PM, this should help you get your loan within a few hours.

For larger loans of $1,500 or $3,000, this may require some extra checks to confirm your income and employment – but it is still common to get your loan on the same day or next business day.

If you are looking for a loan, you should always give your real information in terms of your name, contact details and income to avoid slowing down your application.

In addition, once you have applied, try to stay near to your cell phone and email and be ready to respond to the lender if they have any queries to get funding ASAP.

What is the Eligibility Criteria for Applying for a Payday Advance Loan?

You can apply for a payday advance loan with Dime Alley as long as you meet these following four requirements

- Are over 18 years of age

- Have American citizenship

- Have a minimum monthly income of $800

- Have a current account for us to deposit funds into

Does Dime Alley Offer Payday Advance Apps?

Yes, our panel of lenders includes payday advance apps, which allow you to borrow money on demand and keep track of your payments in real-time.

Some borrowers prefer to use apps because it gives you access to everything you need directly from your cell phone, including the loan terms, repayment dates and the outstanding balance.

Some apps have extra features including advice on saving money, budgeting and topping up your loan if you need to.

Representative Example: $500 Cash Advance

| Length of Loan | Interest and Fees | Total |

| 2-Weeks | $46.25 | $546.25 |

| 1-Month | $92.27 | $592.27 |

| 6-Weeks | $138.05 | $638.05 |

| 2-Months | $183.59 | $683.59 |

| 3-Months | $273.95 | $773.95 |

| 4-Months | $363.39 | $863.39 |

Our Other Products

What People Say About Us

“I need a loan to pay back a friend and it was all very quick and easy to get a couple of hundred bucks which I repaid over a couple of weeks.”

Malik, California, December 2022

“I found Dime Alley on Google and applied in a few minutes. I got an instant decision and approved on the same day and was able to pay to have my car repaired immediately. I paid back the loan in 2 weeks and was sorted.”

Bob, Florida, July, 2021

“Personal and friendly, they did what they said they would do, I was approved for a loan although I have bad credit. It was just a short term thing, but has helped me and my family.”

Merryl, Texas, September 2021

Frequently Asked Questions

Can I Get a Payday Advance Loan With Bad Credit?

If you have a bad credit score, don’t worry – you can still get a payday advance loan!

With Dime Alley, all credit histories are accepted. This means that you should still request a loan with us even if you have already been turned down by a bank because of bad credit.

Was this helpful?

Can I Get A Payday Advance Loan Without a Credit Check?

Dime Alley will consider those looking for no credit check loans, but note that a credit check is usually carried out for all customers.

Was this helpful?

How Much Can I Borrow?

With Dime Alley, you could find a payday advance loan from $100 to $35,000 – with the amount you can borrow based on factors like your monthly income, credit status and affordability.

Other things come into play too, including your residence (homeowners are often preferred), age and whether you have any other similar loans open too.

Was this helpful?

What Is The Repayment Period?

Customers can repay over 1 month to 60 months (or equal to 5 years) – this will depend on whether you prefer the payday option which may be just a few weeks or months, or the longer installment option which can be several years to stretch out your repayments.

Payments are usually made in equal monthly installments from the bank account you choose and you always have the option to repay early if you would like to do so.

Was this helpful?

Are There Any Attached Fees To Apply?

No! We will never charge fees for using our service.

Instead, we take a fee or commission from the lender if your application is approved and successful. The lenders will charge a daily or monthly interest if your loan is active and this will be presented to you in writing before you proceed.

Was this helpful?

Is Dime Alley A Broker or a Lender?

Dime Alley is a broker, meaning that if you’re approved, we don’t provide the funds for your loan directly. Instead, we connect you to a lender best suited to your situation from our trusted panel.

Do not worry though, your information is completely secure and will not be sent or shared with any other companies or third parties and we certainly will not charge you anything for using our service.

Was this helpful?