Apply for Loans for Self Employed People – Borrow up to $35,000

Dime Alley can help you get a self-employed loan from $500, $1,000, $2,000 or higher! We offer loans for contractors, freelancers, gig workers and more. Repay over 1 to 60 months and you can check your eligibility today, with no impact to your credit score!

How To Get a Self-Employed Loan with Dime Alley

With a fully online application form, you can get an instant decision in minutes and successful applications are funded within 1 hour, 24 hours or next business day. At Dime Alley, we treat being self-employed as anyone else with a full-time job. To be eligible, you just need to have a stable income and be able to afford repayments on time and you can get the loan you need!

We Offer Self-Employed Loans For:

- Contractors

- Sub-contractors

- Freelancers

- People who work for themselves

- People who work in family businesses

- Part-time staff

- Gig workers

- Sole proprietorships

- Single Member LLCs

Am I Eligible for a Self-Employed Loan?

You can apply for a loan with us as long as you meet these following four requirements;

- Are over 18 years of age;

- Have American citizenship;

- Have a minimum monthly income of $800;

- Have a current account for us to deposit funds into.

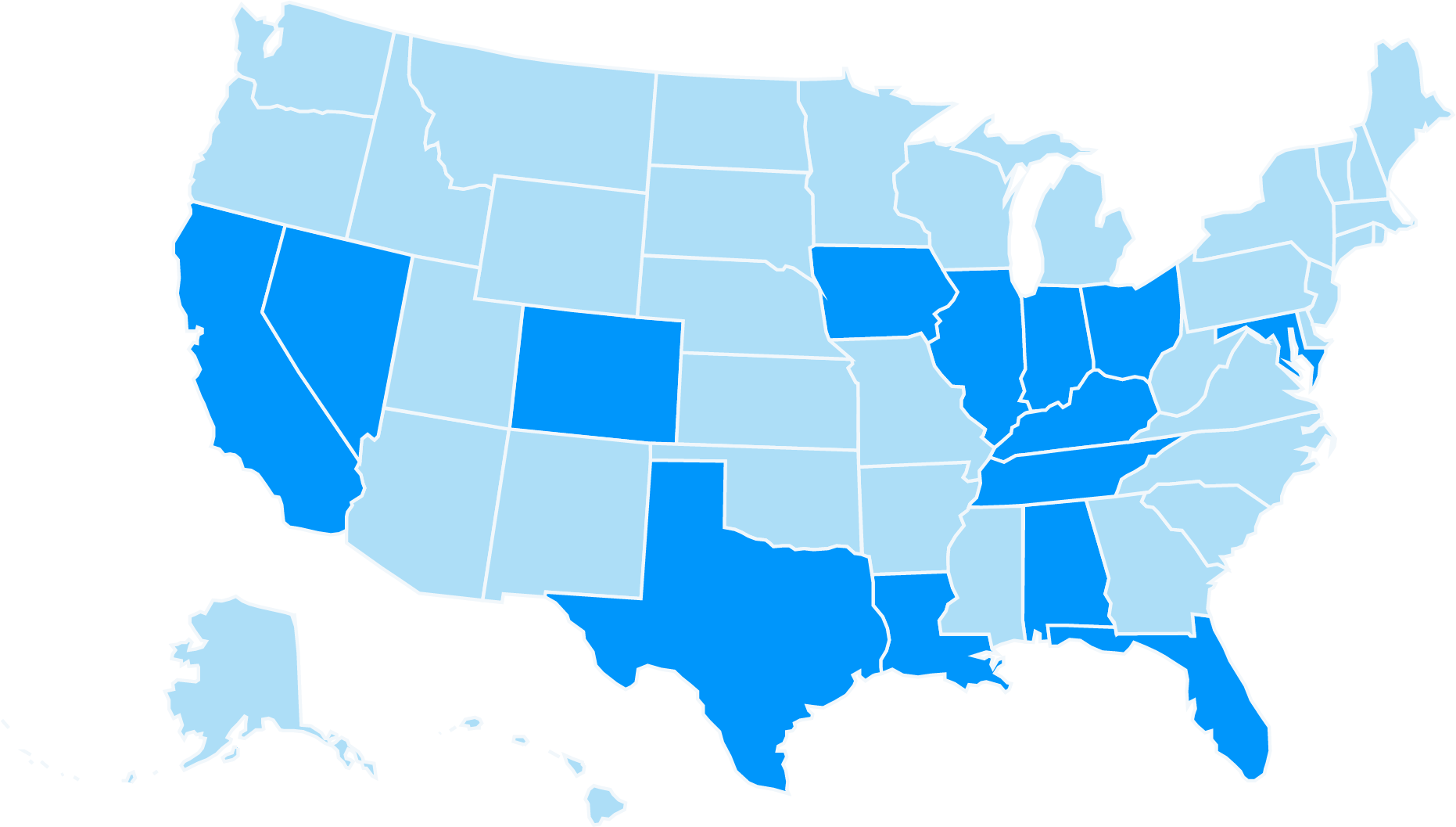

Which States Can I Get a Self-Employed Loan?

We provide loans across 37 states. These include California, Texas and Nevada.

In some of the states we operate in, we are limited by legislation on how much we can lend.

In some states, the interest on loans are limited, such as in South Dakota.

List of US States Where You Can Get a Self-Employed Loan:

When Can I Get my Self-Employed Loan?

You could have the money in your account the very same day you apply for it.

When we receive your application, we connect it with one of our regulated lenders who we deem a good fit for you. We aim to find you a match within 24 hours.

What Credit Score Do I Need For a Self-Employment Loan?

Even if you have a rocky credit history, you can apply for a self-employment loan with Dime Alley!

Our trusted lenders work with borrowers with all kinds of financial records. They aim to provide you with the best available rates to you and help you where they can.

We know that it can be stressful securing a loan when your credit history is imperfect, which is why we consider all applications.

In fact, if you borrow with us and pay it off according to the terms of your agreement, your credit history could even be improved.

How Does Repayment Work on a Self-Employed Loan?

Repayments on your self-employed loan will be withdrawn from your checking account on the same day every month until you have paid off the loan and accompanying interest.

You and your lender will agree on this date together, but most opt to choose their pay day.

Payments are made in equal amounts and you have the ability to pay your loan off early if you can.

However, you should be clear on the repayment terms before deciding to alter your repayment plan.

What People Say About Us

“Dime Alley helped me when I had an emergency. It was fast, simple and effective and I would recommend them to anyone who needs a loan.”

Jane, Nevada, November 2022

“I found Dime Alley on Google and applied in a few minutes. I got an instant decision and approved on the same day and was able to pay to have my car repaired immediately. I paid back the loan in 2 weeks and was sorted.”

Bob, Florida, July, 2021

“Had a good experience and got my loan the next day. I needed it to pay my bills and will consider using it again if I need a loan.”

Darryl, Michigan, February 2023

Self Employed Loans Frequently Asked Questions

Can I Get a Self-Employed Loan With Bad Credit?

If you have a bad credit score, don’t worry – you can still get a self-employment loan!

With Dime Alley, all credit histories are accepted. This means that you should still request a payday loan with us even if you have already been turned down by a bank because of bad credit.

Was this helpful?

How Much Can I Borrow?

With Dime Alley, you could find payday loans ranging from $100 to $35,000 – with the amount you can borrow based on factors like your monthly income, credit status and affordability.

Other things come into play too, including your residence (homeowners are often preferred), age and whether you have any other similar loans open too.

Was this helpful?

Can I Get a Self-Employment Loan With No Credit Check?

Dime Alley will consider those looking for no credit check loans, but note that a credit check is usually carried out for all customers.

Was this helpful?

How Much Will I Pay In Interest?

The price cap on your self-employment loan, i.e. the rate of interest that a lender will charge you, varies depending on your local state regulations.

Payday loans are prohibited completely in 12 states and in 18 states, interest is capped at 36% on a $300 loan.

For $500 loans, 45 states and Washington D.C. have caps in place but these vary from state to state and can be very high – the average is 38.5%.

Was this helpful?

Am I Charged a Fee For Applying With Dime Alley?

No! We will never charge fees for using our service.

Instead, we take a fee or commission from the lender if your application is approved and successful. The lenders will charge a daily or monthly interest if your loan is active and this will be presented to you in writing before you proceed.

Was this helpful?

Is Dime Alley a Broker?

Yes! Dime Alley is a broker, meaning that if you’re approved, we don’t provide the funds for your loan directly. Instead, we connect you to a lender best suited to your situation from our trusted panel.

Do not worry though, your information is completely secure and will not be sent or shared with any other companies or third parties and we certainly will not charge you anything for using our service.

Was this helpful?