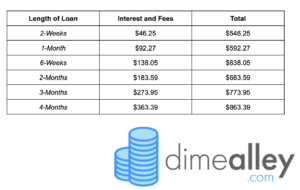

A $500 Payday Loan will cost you $546.23 after two weeks, $592.27 after 1 month and $773.95 after 3 months.

The average loan is for around $300 to $500 and is used for a period of 2 to 4 weeks.

Below you can see the full cost breakdown of a $500 payday loan;

How Much Do Payday Loans Cost?

The cost of a $500 payday loan is $546 after two weeks and $592 after four weeks, and they get more expensive the longer you hold them. For that reason, whilst they are useful for emergencies due to their fast nature, they should not be used for long-term purposes. Additionally, most loan applications are automated, and so applications are often completed and funded with 1 hour or the same day of applying.

The APR for a payday loans is usually around 300% to 600% depending on the state you live in and your personal criteria, such as credit score and residential status which can impact the rate you are charged.

Using the table above could be very helpful for you to understand how much a payday loan costs – it becomes more expensive the longer you borrow for and importantly, the fees really start to add up if you cannot keep up with repayments.

Why Do Payday Loans Have High APR?

The APR rate for payday loans is usually very high, ranging from 300% to 600%, which seems extortionate when you consider a credit card is around 16%.

But ultimately, what makes the APR rates so high is that the loan is treated as if it lasted 12 months, because this is how APR works, it is an ‘annual’ measure to make it easily comparable to other financial products.

APR compounds a product over a year, which only truly lasts a few weeks. This already inflates a very high interest rate which is more than the average personal loan to cover the transaction fees, the fact that it is unsecured and there is a higher default rate than other types of loans (around 15-20%). When you put all these together, you get a payday loan APR which is around 300% to 600% in the US.

Why Are Payday Loans Expensive?

Payday Loans are unsecured.

Payday loans are typically a type of unsecured loan, which means that you do not need to use any security or collateral when applying and therefore the lender has nothing to collect or repossess if you cannot repay your loan.

Therefore, when the lender assess your application, they base your eligibility on factors such as income, location, credit score and employment.

If you fail to make your loan repayments, the lender loses out and cannot repossess anything to cover the debt, and so lenders charge a higher rate on payday loans to make up for this.

Payday Loans have high default rates.

The CFPB estimates that 80% of payday loans get rolled over and 20% end up in default, which is essentially the percentage of customers who cannot make repayments on time or at all. Therefore, unpaid payday loans are classed as ‘bad debt’, meaning the lender will not be able to cover their losses at all.

This means that rates need to be a little higher to make up for the losses of other people, which makes payday loans a more expensive product than other financial products with far lower default rates.

Payday Loans are short-term.

Payday loans are designed to be short-term loans and therefore the rates are higher to reflect this and also make it worthwhile for the lender.

If a lender decided to lend a borrower a large sum of money, such as $500 or $1,000 for just two weeks, it is a lot of risk for them and therefore they need to charge you a large interest rate to make it worthwhile for them.

What If I Cannot Repay My Payday Loan?

If you realize you will be unable to meet a scheduled payday loan repayment, you should make sure to contact your lender immediately. Your lender will try to find an arrangement that makes it possible for you to repay the loan. You may be able to agree to a payment schedule that would be more affordable.

Failing to repay your debts can lead to late fees, damage to your credit record, and threatened legal action. If you have declared collateral in your contract, you could lose assets.

Therefore, it is important to remember when you first apply that you should never take out more money in the first place that you know that you will be able to afford to pay back when the repayment is due. A payday loan is a financial product that should only be used a short-term fix for an unexpected bill, or just to tide you over before the next payday.