No Credit Check Loans - Find Options With Guaranteed Approval

No Credit Check Loans can be a good option if you have been turned down because of bad credit. Whether you need to borrow $300, $1,000 or $2,000 through a payday loan or collateral loan, Dime Alley can help you find the best options and funding is available in 1 to 24 hours.

What Are No Credit Check Loans?

A no credit check loan is a type of personal loan where the lender does not perform a traditional credit check to assess the borrower’s credit history or creditworthiness. Instead of relying on the borrower’s credit score, these loans are typically approved based on other factors such as the borrower’s income, employment status and ability to repay the loan.

In the United States, it was estimated that around 12 million Americans use payday loans annually. Borrowers should thoroughly understand the terms and costs associated with these loans before taking one out and should explore alternative borrowing options if possible.

There are many types of loan that may not require a credit check, including payday loans, title loans, bad credit loans, and installment loans. No credit check loans are often used by individuals who have poor credit scores or a limited credit history and may have difficulty qualifying for loans through traditional lenders.

How Are No Credit Check Loans Different From Traditional Loans?

Ability To Repay

No credit check loans differ from traditional personal loans because instead of checking your credit score from the major credit bureaus, lenders primarily assess your current financial situation to gauge your ability to repay. They typically consider factors like your income, job stability, and sometimes personal references.

This unique approach makes it possible for individuals with poor or nonexistent credit histories to obtain loans. However, these loans may come with higher interest rates due to the potential financial risk taken by lenders. For example, payday loans often have some of the highest Annual Percentage Rates (APRs).

Soft Search Approach

One significant distinction between these loans and traditional personal loans is that no credit check loans, such as payday loans, usually don’t require a hard credit inquiry during the application process. Nevertheless, these lenders may conduct a soft credit check to confirm that the borrower isn’t undergoing bankruptcy or pre-bankruptcy credit counseling.

In contrast, traditional personal loan providers typically scrutinize an applicant’s credit history and credit score, often rejecting those with poor credit scores.

Focus On The Present

Lenders offering no credit check loans may place more emphasis on a borrower’s present income and their ability to repay, rather than dwelling on past credit behavior. This is why many individuals with bad or no credit regard these loans as suitable options, especially for emergencies.

This approach enables people with unfavorable credit or no credit history to access loans more easily. However, it’s crucial to be aware that payday loans and similar products often entail higher interest rates, fees, and shorter repayment terms. If you’re considering a bad credit loan, it’s essential to conduct thorough research on the lender and the loan terms.

Am I Eligible to Apply for a No Credit Check Loan?

Yes, if you meet the following criteria, you are eligible to submit a loan request:

- Over 18 years old

- Hold American citizenship

- Have a checking account for us to deposit your funds into

- Have a minimum monthly income of $500

- Steadily employed – either part-time, full-time or self-employed

- Must have a working US cell number and email address

- No recent bankruptcy

Steps to Apply For Loans With No Credit Check

Step 1: Enter Your Details

Click on the ‘Apply Now’ button and submit your information including how much you want to borrow and how long for and any other loan requirements in less than 5 minutes.

Step 2: Get A Decision and eSign Your Agreement

We will match your requirements with more than 50 US and Canadian lenders and if you wish to proceed with the offer presented, you can e-sign your loan agreement and the lender will carry out some final checks.

Step 3: You Are Approved!

If all checks have been confirmed and you have been fully approved, your loan can be successfully funded to your bank account within 1 hour, 24 hours or the same day.

Where Can I Find No Credit Check Loans Near Me?

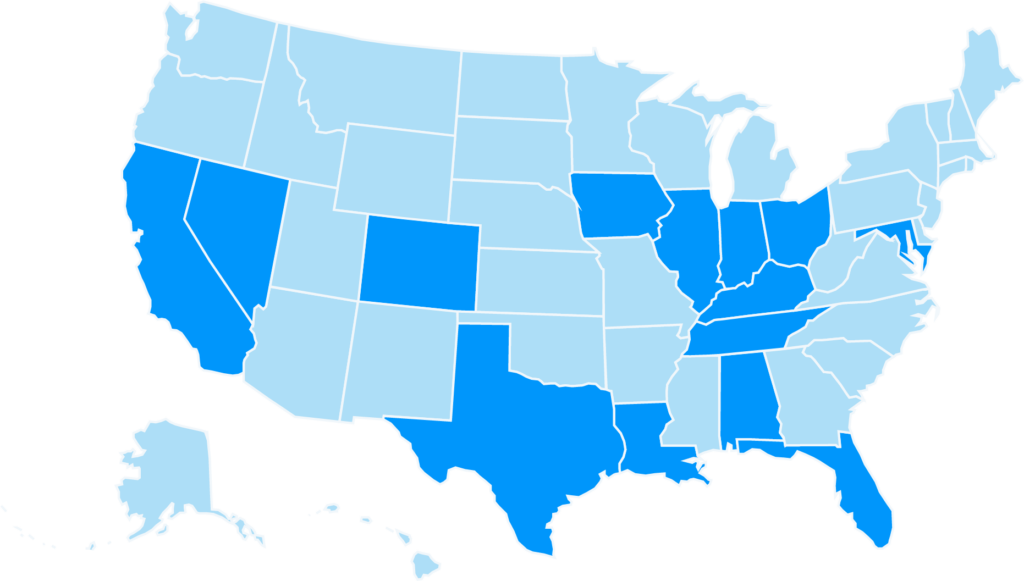

You can find no credit check loans in states such as Alabama, California, Colorado, Florida, Kentucky, Illinois, Indiana, Iowa, Louisiana, Maryland, Nevada, Ohio, Texas, Tennessee and Wisconsin.

In certain states, lenders can offer no credit check loans, including payday loans, title loans and other similar products. These states often have specific regulations and laws governing the terms and conditions of such loans to protect consumers.

Other states have strict regulations in place or outright ban no credit check loans due to concerns about predatory lending practices and the high costs associated with these loans. In these states, lenders may be subject to interest rate caps or other restrictions that make it difficult to offer such loans.

State regulations on no credit check loans can change over time. Legislators may introduce new laws or amend existing ones to address concerns about these loans, so it’s essential to stay updated on the regulations in your specific state.

Benefits of No Credit Check Loans

- Accepts Bad Credit: No credit check loans are often more accessible to individuals with poor credit or no credit history. This makes them an option for those who may have difficulty obtaining loans from traditional lenders.

- Quick Approval: Because lenders don’t conduct extensive credit checks, the approval process for loans without checks is typically faster than traditional loans, unless it is for secured loans which requires valuations of your assets and can take a few days.

- Flexible Use: Borrowers can use the funds for various purposes, including covering unexpected expenses, medical bills or auto repairs

- Build Credit: Some lenders may report repayment of these loans to credit bureaus. If you make timely payments, it can potentially help improve your credit score over time.

Disadvantages of No Credit Check Loans

- High Interest Rates: No credit check loans often come with significantly higher interest rates and fees compared to traditional loans. A payday loan can cost around 200% to 400% APR whereas a credit card or loan with bad credit can only cost a maximum of 36%.

- Short Repayment Periods: Many no credit check loans have short repayment terms, often requiring full repayment within a few weeks. It is important that you have a plan to make payments on time or the fees can quickly start to add up.

- Debt Spiral: Due to their high costs, borrowers may find themselves trapped in a cycle of debt if they cannot repay the loan on time. They may feel obliged to take out additional loans to cover the previous one, leading to a cycle of borrowing and this is not healthy.

- Predatory Lenders: Some lenders offering loans without credit checks engage in predatory lending practices, taking advantage of vulnerable borrowers. It’s crucial to research and choose a reputable lender.

- Risk of Losing Collateral: If you’re using collateral (e.g., a vehicle) to secure the loan, you could risk losing the collateral if you default on payments, otherwise known as foreclosure.

- Limited Loan Amounts: If you have no credit, the amount you can borrow may be very limited to amounts such as $100 or $300. However, if you use collateral such as a car, this could be increased.

Types of No Credit Check Loans

Payday Loans

Payday loans are short-term loans intended for individuals with poor credit. They’re meant to be repaid on your next payday, and credit checks are typically not required. However, they often come with high fees and interest rates, which can lead to a cycle of debt.

Peer-to-Peer (P2P) Loans

P2P lending platforms connect borrowers with individual investors who are willing to lend money. For investors, they could receive a high return by lending to people with riskier credit profiles – and this has been able to help a lot of people in the past.

Secured Loans

Secured loans require collateral, like a car, home or valuable asset. Lenders may be more lenient with credit checks when collateral is involved, but failing to repay could mean losing the prized asset.

Title Loans

Title loans allow you to use your vehicle’s title as collateral for a loan, regardless of your credit score. The loan amount is usually based on your vehicle’s value, age and condition (up to 50% of its value) and the lender becomes a lienholder on the title. Failing to repay can result in losing your vehicle.

Personal Installment Loans

Personal installment loans are different from payday and title loans. While they may not involve traditional credit checks, they typically offer longer repayment periods. You repay these loans through a series of scheduled payments over time. They often have fixed interest rates and predictable monthly payments, making them more manageable.

Online Loans

Online lenders offer various loan types with less strict credit checks. These lenders provide convenient and accessible digital platforms for loan applications.

Regulations and Laws Around No Credit Check Loans

Federal Regulations

Truth in Lending Act (TILA)

TILA is a federal law that requires lenders to disclose key terms and costs of credit, including interest rates and fees. This law applies to all types of loans, including no credit check loans, ensuring borrowers have clear and transparent information about the loans they are offered.

Equal Credit Opportunity Act (ECOA)

ECOA prohibits discrimination in lending based on factors like race, color, religion, national origin, sex, marital status, or age. This law applies to all types of loans, including those without credit checks.

State Regulations

State laws play a significant role in regulating no credit check loans. Regulations can vary widely from state to state, and some states have strict laws that govern these types of loans, while others have fewer regulations. Here are some common state-level regulations:

- Interest Rate Caps: Many states impose interest rate caps or usury laws that limit the maximum interest rate a lender can charge on loans. These caps may apply to no credit check loans, impacting the cost of borrowing.

- Loan Amount Limits: Some states limit the maximum loan amount that can be offered, especially for payday loans and other short-term loans.

- Loan Term Restrictions: States may have laws that limit the duration of no credit check loans, ensuring they are not excessively long-term.

- Licensing and Registration: States often require lenders to obtain licenses or register to operate within their borders, ensuring that they comply with state laws and regulations.

- Rollover and Renewal Restrictions: To prevent borrowers from falling into a cycle of debt, some states restrict the number of times a loan can be rolled over or renewed.

- Cooling-Off Periods: Some states impose cooling-off periods, which require a waiting period between taking out one loan and applying for another.

- Database Requirements: A few states maintain databases to track borrowers’ loan histories and prevent them from taking out multiple loans simultaneously.

What Are The Repayment Terms of No Credit Check Loans?

Generally borrowers can repay over 1 month to 60 months (or equal to 5 years) – this will depend on whether you prefer the payday option which may be just a few weeks or months, or the longer installment option which can be several years to stretch out your repayments.

Payments are usually made in equal monthly installments from the bank account you choose and you always have the option to repay early if you would like to do so. However, there are some common generalizations you can expect.

Payday loans typically have very short repayment periods, often requiring full repayment on your next payday, which is typically within two to four weeks. Borrowers are usually required to repay the entire loan amount, including fees and interest, in one lump sum.

Title loans often have slightly longer repayment periods compared to payday loans, but they are still relatively short-term. Repayment may be due within 30 days, with the option to renew or roll over the loan. Some borrowers may choose to roll over their title loans by paying the interest and fees while extending the principal loan amount to a new term.

Personal installment loans typically offer more extended repayment periods compared to payday and title loans. Repayment may occur over several months or even years. Borrowers are required to make regular, scheduled payments, often monthly, until the loan is fully paid off.

The repayment terms for online no credit check loans can vary widely depending on the lender. Some may offer short-term loans with payday-like repayment terms, while others may provide longer-term installment loans.

Secured loans, such as those secured by collateral like a vehicle or savings account, can have varying repayment terms. The terms may be negotiated between the borrower and lender and can range from short-term to longer-term loans.

What Are the Interest Rates on No Credit Check Loans?

Interest rates on no credit check loans can vary widely depending on the type of loan, the lender, and the laws and regulations in your state. Rates vary by lender, but according to the Federal Reserve Bank of St. Louis, the average APR for a no credit check payday loan can be around 400%.

Here are some general guidelines:

- Payday Loans: Payday loans, which are a common type of no credit check loan, often come with extremely high annual percentage rates (APRs). APRs can range from 300% to 600% or even higher in some cases such as states like Nevada. These high rates are a major reason why payday loans can be financially risky.

- Title Loans: Title loans also tend to have high APRs, typically in the triple digits. Like payday loans, these rates can vary depending on the lender and state regulations. Lenders may charge additional fees on top of the interest, which can significantly increase the overall cost of the loan.

Resources For Borrowers With Bad Credit

If you have bad credit and want to improve it, there are several resources that might be able to help you to make the steps to improve your credit score. These include:

- Credit Counseling Agencies: Nonprofit credit counseling agencies offer guidance on managing debt, creating budgets, and improving credit. They can provide personalized advice and assistance in developing a plan to address your financial challenges.https://www.nfcc.org/

- MyMoney.gov: This government website provides valuable resources and tools for managing your finances, including information on budgeting, credit management, and financial planning. https://www.mymoney.gov/

- HUD-Approved Housing Counseling Agencies: If you’re looking to buy a home but have credit issues, HUD-approved housing counseling agencies can provide advice on credit repair, budgeting, and homeownership preparation. https://www.hud.gov/i_want_to/talk_to_a_housing_counselor

- Consumer Financial Protection Bureau (CFPB): The CFPB offers educational materials and resources on credit reports, scores, and managing debt. They also provide information on disputing errors on your credit report. https://www.consumerfinance.gov/

Alternative Options to No Credit Check Loans

Credit Builder Loans

Credit builder loans are specifically designed to help individuals establish or improve their credit. These loans often have low interest rates and are structured to build a positive credit history. However, loan proceeds may be held in an account until the loan is repaid, so you won’t have immediate access to the funds.

Borrowing from Family and Friends

Borrowing from trusted family members or friends typically doesn’t involve a credit check. It may offer low or no interest rates and flexible repayment terms. However, it’s essential to establish clear terms and communication to avoid straining relationships if you’re unable to repay.

Emergency Assistance Programs

Nonprofit organizations and local government agencies may offer emergency financial assistance programs that provide grants, low-interest loans, or other forms of support to individuals facing unexpected expenses. These programs can provide immediate financial assistance.

Frequently Asked Questions of No Credit Check Loans

What Are No Credit Check Loans?

No credit check loans are short-term lending options, like payday loans, that do not require a hard credit inquiry. This means your low credit score won’t impact the lender’s decision to approve the loan.

Was this helpful?

Who Qualifies for No Credit Check Loans?

In general, individuals with a consistent income source, a valid bank account, and proper identification can qualify for a no credit check loan.

Was this helpful?

How Quickly Can I Receive Funds From a No Credit Check Loan?

Depending on the lender, funds can be disbursed rapidly, sometimes within 24 hours or even on the same day.

Was this helpful?

Can a Loan With No Credit Check Impact My Credit History?

No, not directly. Since no credit check loans do not require a hard credit inquiry and usually do not report to major credit bureaus, they typically do not impact your credit score. However, failing to repay the loan could negatively affect your credit history.

Was this helpful?

Do No Credit Check Loans Require Any Verification?

While credit checks are not necessary, lenders often verify your income and bank account details to ensure you can repay the loan.

Was this helpful?

How Much Can I Borrow With a No Credit Check Loan?

With Dime Alley, you could find loans ranging from $100 to $35,000 – with the amount you can borrow based on factors like your monthly income, credit status and affordability.

Other things come into play too, including your residence (homeowners are often preferred), age and whether you have any other similar loans open too.

Was this helpful?

What Happens if I Can't Repay a No Credit Check Loan on Time?

Failure to repay on time can result in additional fees, penalties, and an increased overall amount owed. It can also harm your credit score.

Was this helpful?

Are No Credit Check Lenders Safe?

Yes, many are, but be cautious of scammers. While many online lenders are reputable, it’s crucial to exercise caution and research the lender’s legitimacy before applying. Look for customer reviews, check if the lender is licensed, and review the loan terms carefully.

Was this helpful?

What Are the Risks of No Credit Check Loans?

The main risks include high interest rates, short repayment terms, and the potential for a cycle of debt if you cannot repay on time. Some lenders may also have predatory practices, so it’s essential to choose a trustworthy lender.

Was this helpful?

Can I Apply for Multiple No Credit Check Loans Simultaneously?

Yes technically you can, but it’s generally not advisable to apply for multiple loans at the same time, as each application can result in a hard inquiry on your credit report, potentially harming your credit score. Consider your financial needs carefully before applying for any loan.

Was this helpful?

Is a Co-signer Required for No Credit Check Loans?

No, no credit check loans typically do not require a co-signer. These loans are often unsecured, meaning they don’t involve a co-signer or collateral.

Was this helpful?

Editor’s Note

No credit check loans can be a helpful option if you need quick access to funds and are confident about repaying them later. These loans can assist with unexpected expenses and filling financial gaps until you can pay back the borrowed amount along with interest.

However, it’s crucial to select a trustworthy lender that offers fair terms, reasonable rates, and favorable repayment plans for no credit check loans. Always ensure you fully comprehend the loan’s rules, interest rates, and fees before you proceed.

Before you decide to borrow money, whether it’s from an online source or in person, take a moment to assess your financial situation and understand your true needs. It’s essential to fully grasp all the costs, rules, and terms related to the loan.

Being a responsible borrower who makes timely payments is not only essential for managing your debts and improving your financial situation but also for potentially securing better loan terms and smoother approvals if you need to borrow again down the road.