Homeownership is not just another investment. It’s one of the biggest investments you’ll ever make. What they don’t tell you, however, is that with homeownership comes some repairs, remodels and improvements.

You could be interested in starting some home improvements to add value for your sale or rental, or perhaps just to make it a nice place to live for yourself and maybe your family.

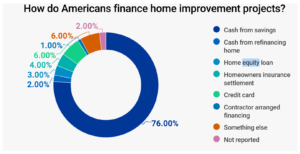

However, home improvements can be a big expense, which needs to be paid for somehow. One of the biggest questions you may ask as you plan any home renovation is how to pay for home improvements.

Home Improvement Facts and Stats

- About 80% of houses in the United States are at least 20 years old, therefore they require home improvements and remodeling.

- In 2018, the average cost for kitchen remodeling costs came to a total of $14,000, and this is a figure that has only risen since then.

- In 2021, U.S. home improvement sales reached $538 billion.

- According to Statista, 76% of respondents stated they had made at least one improvement to their home during the coronavirus pandemic in the United States.

How To Pay For Home Improvements

The cost of a home improvement project can add up fast, but there are several options for financing home improvements, whether the project is considered big or small. Here we will explore how to get money for home improvements:

Savings

The most common way to finance your home improvement in the United States is to use a part of your personal savings. According to the Census Bureau, approximately 76% of people who undertake home improvement projects use this method of finance.

If you don’t already have a large sum of money saved, this option can mean waiting longer to start your project. But, it also means you won’t have to worry about paying back a loan or large credit card bill once you finish your home renovation.

The amount you need to save depends on what type of renovation you’re doing and the scope of the project. If you’re looking to finance the whole project by saving, it might be smart to start small and take on less expensive projects first. This will ensure that you don’t get in over your head and wind up spending more than you intended.

Home Improvement Loan

Home improvement loans are a type of personal loan which can be offered by banks, credit unions and also some online lenders.

Because the loans are unsecured, you don’t need to use your house as collateral to qualify and generally speaking, funding for home improvement loans comes quickly; once you agree to the terms, many lenders deposit money straight into your account in as soon as 24 hours.

You can apply for a home improvement loan for any sized project, but typically, lenders will be happy to offer you between $100 – $35,000. Lenders will take into account things such as your income, your financial history and your credit score, but unlike with banks, online lenders offer loans to people with a variety of credit scores, i.e. you don’t need perfect credit!