Cash Advance Loans Near Me

Get a cash advance online with Dime Alley to receive money upfront for an emergency or important purchase. We offer a completely online application with instant approval and options for bad credit scores and no credit checks. Get funds in 24 hours and can you can borrow $300, $500 or $1,000 today. Simply click on the ‘Apply Now’ button to check your eligibility.

What is a Cash Advance?

A cash advance is a short-term loan to help you cover your living costs. Cash advances are typically used when a customer is in need of money and can’t quite wait until their next pay day.

Dime Alley can help you find a cash advance in the form of a payday loan. 7 in 10 borrowers take out a payday loan for regular, necessary expenses highlighting that there are many people across the US who are in need of financial help.

We are here to help you find the right loan for you. Even if you have bad credit history, as a broker, we will connect you to a lender who won’t necessarily focus on your credit history. They will look at other factors, such as your employment status and income, when considering your application.

Why Would I Need a Cash Advance Loan?

You might need a cash advance loan for a number of reasons. This can be unexpected costs and emergency expenses such as

- Unforeseen medical bills

- Dental bills

- Car and auto repairs

- Home repairs or improvements

- Utility bills

- Rent

- To help a friend or family member

A cash advance can provide money upfront before your next pay day, which you can repay over a series of weeks or months depending on your preference. This form of loan removes the need to wait until payday, and means that when you need a helping hand, you can find it through the quick, easy and free online application from Dime Alley.

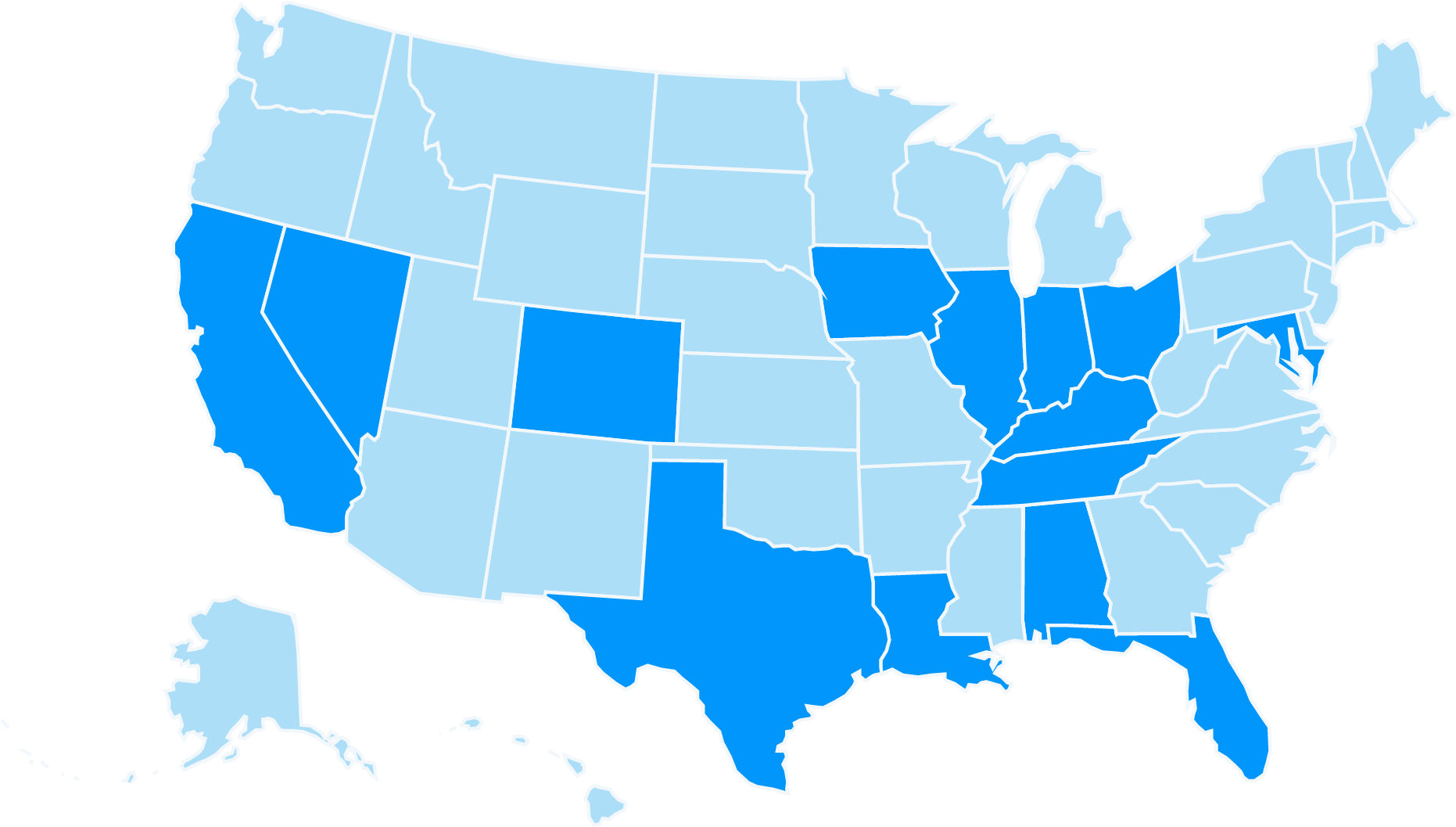

Where Can I

Cash Advance Near Me?

Dime Alley proudly operates in the following states:

What Type of Cash Advance Are There?

Payday Loans

Payday loans are short-term, high-interest loans typically intended to cover expenses until the borrower’s next payday. Payday loans are often used for emergencies, unexpected bills, or when individuals need cash quickly but don’t have access to traditional credit options.

Credit Card Cash Advances

This involve withdrawing cash from an ATM through your credit card. The amount you can withdraw is usually limited to a portion of your credit limit.

Merchant Cash Advances

Merchant cash advances are a form of business financing where a business owner receives a lump sum of cash upfront in exchange for a percentage of future credit card sales. Repayment is made daily or weekly through a portion of credit card sales.

Cash advances are typically more expensive than other forms of borrowing due to high interest rates and fees. Exploring alternative options, such as personal loans, lines of credit or emergency savings, is always advisable.

What Are The Pros and Advantages Of A Cash Advance?

-

- Fast Access to Funds: Cash advance loans are known for their speed and convenience. In emergencies or urgent financial needs, they can provide rapid access to cash, often within hours or even minutes, which can be critical when facing unexpected expenses.

- Minimal Credit Requirements: Cash advance lenders may have more lenient credit requirements compared to traditional banks or credit card companies. This can make them accessible to individuals with poor or limited credit histories.

- No Collateral Required: The loans are unsecured, meaning you do not need to provide collateral (like a car or home) to secure the loan. This reduces the risk of losing valuable assets if you can’t repay.

- Flexibility in Use: Borrowers have the flexibility to use the money for various purposes, whether it’s covering medical bills, car repairs, or other immediate expenses.

What Are The Disadvantages and Cons of a Cash Advance?

- High Interest Rates: Cash advance loans typically come with high interest rates such as 200% to 400% APR, which often significantly higher than those for traditional loans or credit card purchases from 8% to 36% APR. This can result in substantial borrowing costs.

- Fees: In addition to high interest rates, beware additional fees, such as ATM withdrawal fees and additional service charges. These fees can increase the overall cost of the loan.

- Short Repayment Terms: Cash advances usually have very short repayment terms, often due on the borrower’s next payday which may only be 2 to 4 weeks time. This can lead to financial strain and may make it difficult to repay the loan in such a short timeframe.

- No Grace Period: Unlike regular credit card purchases, there is typically no grace period for interest. Interest begins accruing immediately from the day the cash is withdrawn.

- Credit Score Impact: Some bigger lenders or mortgage providers might be more cautious if you have cash advances and payday loans on your credit report and your score can be affected if you miss or fall behind on repayments.

Why Should I Get a Cash Advance with Dime Alley?

When you need a cash advance, you are likely to be pressed for time. With a fully online application, you can receive an instant decision and subject to further checks, your loan can be funded in 1 to 24 hours.

Dime Alley is reliable, as we only work with regulated and legitimate lenders across the US and Canada. We offer payday loans in California and other states where they are legal such as Texas and Nevada. If you apply from other states, you will be offered a product with a price cap of 36% APR, such as personal or installment loans.

If you apply with us, we will match you with the lender best suited to you and your needs. This means that they will provide you with the best available terms and the company who is most likely to approve you. But there is no obligation to proceed and you can always take your time.

Do I Qualify For a Cash Advance?

- Over 18 years old

- Hold American citizenship

- Have a checking account for us to deposit your funds into

- Have a minimum monthly income of $800

- Steadily employed

If you meet these criteria, we can help you get a cash advance today!

Can I Get a Cash Advance Loan with Bad Credit Scores?

Yes, we provide cash advances for people with all credit backgrounds, even borrowers with bad credit. Don’t worry if you need a loan with bad credit, we will help you secure a cash advance that suits your needs.

Our lenders provide funds for borrowers with poor credit – although it is worth bearing in mind that this may affect your repayment terms and the rates you’re offered.

How Do I Apply For a Cash Advance with Dime Alley?

Click ‘Apply Now’ today to begin our quick, easy and free application process for a cash advance. You can fill it out at any time!

You should only do this if you are confident that a cash advance is the right choice for you. If it is, then we would be delighted to become your lending partner. Fill out our quick and easy online form today to be one step closer to receiving the cash advance you need.

We will ask for a few details, such as your date of birth, how much you hope to borrow, how long for, and your employment status.

When Might a Cash Advance Not Be The Best Solution?

A cash advance may not be the best solution in several circumstances, including:

Long-Term Financial Problems

If you are consistently struggling to make ends meet, have ongoing debt issues, or face substantial financial challenges, a cash advance may provide temporary relief but is unlikely to address the root causes of your financial instability. In such cases, seeking comprehensive financial counseling or exploring long-term solutions like debt consolidation is often more advisable.

Non-Essential Expenses

Cash advances are typically intended for urgent and essential financial needs, such as unexpected medical bills or car repairs. They are not a suitable means to finance non-essential purchases like vacations, entertainment, or luxury items. Using a cash advance for non-essential expenses can lead to unnecessary debt and financial strain.

Borrowing to Repay Debt

Taking out a cash advance to pay off existing debt can lead to a cycle of debt and financial instability. If you find yourself considering a cash advance to manage your existing debts, it’s often more prudent to explore debt consolidation, negotiation with creditors, or other debt management strategies.

What Alternatives Are There To Borrowing A Cash Advance Loan?

-

-

- Emergency Fund: Building and maintaining an emergency fund is one of the best ways to prepare for unexpected expenses without resorting to loans. Having a dedicated savings account can provide financial security during emergencies.

- Personal Loan: You can apply for a personal loan from a bank, credit union, or online lender. Personal loans typically have lower interest rates and more favorable terms compared to cash advances.

- Credit Card Purchase: If you have a credit card, you can use it for necessary purchases instead of taking a cash advance. This allows you to benefit from the card’s grace period and potentially lower interest rates on purchases.

- Borrowing from Family or Friends: Consider reaching out to family members or friends for a loan, especially for short-term financial needs. Be sure to establish clear repayment terms to avoid straining relationships.

- Credit Counseling: Seek assistance from a credit counseling agency. They can help you create a budget, negotiate with creditors, and explore debt management strategies to improve your financial situation.

-

What People Say About Us

“I found Dime Alley on Google and applied in a few minutes. I got an instant decision and approved on the same day and was able to pay to have my car repaired immediately. I paid back the loan in 2 weeks and was sorted.”

Bob, Florida, July, 2021

“Had a good experience and got my loan the next day. I needed it to pay my bills and will consider using it again if I need a loan.”

Darryl, Michigan, February 2023

“Personal and friendly, they did what they said they would do, I was approved for a loan although I have bad credit. It was just a short term thing, but has helped me and my family.”

Merryl, Texas, September 2021

More FAQs and Common Questions

Am I Charged a Fee For Using Dime Alley?

No! We will never charge fees for using our service.

Instead, we take a fee or commission from the lender if your application is approved and successful. The lenders will charge a daily or monthly interest if your loan is active and this will be presented to you in writing before you proceed.

Was this helpful?

Can I Get Cash Advance Payday Loans in Canada?

Yes, our lenders operate across the 37 states where payday lending is legal in the United States, and all across Canada too!

No matter if you live in Toronto, Vancouver or Montreal, you can apply for a cash advance loan with Dime Alley today.

We consider borrowers with all sorts of credit histories, so don’t let a bad credit score stop you from applying online today.

Was this helpful?

Will Applying Affect My Credit Score?

No! Rest assured, the act of applying for a cash advance loan with Dime Alley will not have any impact on your credit, as we only initially carry out soft credit checks.

Was this helpful?

How Do Cash Advances Work?

Cash advances are a form of financial borrowing providing quick access to funds. Often a cash advance loan is repaid in full on the borrower’s payday.

Was this helpful?

Can I Get a Cash Advance Instantly?

Dime Alley is committed to working quickly and efficiently, meaning you could be approved and funded within one hour. However, Dime Alley can take up to 24 hours to provide you with your funds.

This is because our lenders need to conduct checks to ensure they are providing you with the most suitable loan at the best rates. They may need to contact you to confirm your income, credit score and employment status.

Should you need cash quickly, you are more likely to receive this if you submit your application with Dime Alley on a work day between 9AM and 5PM.

Was this helpful?

How Do Repayments Work For A Cash Advance?

The repayment terms for your cash advance will be decided upon with your chosen lender. Repayments are usually collected automatically on your next payday making the process hassle-free.

Was this helpful?

Are There Any Restrictions On Applying For A Cash Advance?

You must meet the eligibility criteria before applying for a cash advance. This includes being over the age of 18, having a stable source of income and having a living checking account for funds to be deposited into.

Was this helpful?

How Much Can I Borrow in a Cash Advance Loan?

Cash advances from most lenders are commonly issued for amounts in the region of $100-$1,000, however certain payday lenders might be able to offer larger amounts.

Was this helpful?

What's the Difference Between a Cash Advance and Payday Advance?

To avoid any confusion, a payday advance loan is actually a type of cash advance loan, whereby your employer can offer you a percentage of your wages before payday if need be.

Was this helpful?

What is The Repayment Period on My Cash Advance Loan?

Customers can repay over 1 month to 60 months (or equal to 5 years) – this will depend on whether you prefer the payday option which may be just a few weeks or months, or the longer installment option which can be several years to stretch out your repayments.

Payments are usually made in equal monthly installments from the bank account you choose and you always have the option to repay early if you would like to do so.

Was this helpful?

Is Dime Alley a Broker or Direct Lender?

Yes! Dime Alley is a broker, meaning that if you’re approved, we don’t provide the funds for your loan directly. Instead, we connect you to a lender best suited to your situation from our trusted panel.

Do not worry though, your information is completely secure and will not be sent or shared with any other companies or third parties and we certainly will not charge you anything for using our service.

Was this helpful?

How Quickly Can I Get A Cash Advance?

In some cases, same day funding if possible for a cash advance. However, Dime Alley can take up to 24 hours to provide you with your funds.

Was this helpful?

What Happens If I Cannot Repay My Cash Advance?

If you become aware that you will be unable to meet your repayments for your cash advance it is essential to contact your lender immediately. Failing to repay on time can lead to late fees, and could be recorded on your credit report which will impact your ability to get approval for future cash advances.

Was this helpful?

What Are The Consequences For Missing Repayments?

If you miss payments, you will usually have around 24 hours to respond before interest or late fees are charged. Otherwise, you will usually be charged a one-off late ranging from $25 to $50, depending on the lender, the daily interest will continue to accrue and it could negatively impact your credit score.

Was this helpful?

Editorial Note

Before deciding to take out a cash advance loan, installment loan or credit card, it’s essential to take a moment to consider all your available options. While products similar to payday loans can offer swift access to funds in emergency situations, it’s important to be mindful of their high fees.

We strongly encourage you to thoroughly review all your options when you find yourself in need of a loan. By doing so, you can make an informed choice that aligns with your financial well-being and long-term goals. Your financial stability is of utmost importance, and careful consideration is key to achieving it.

Sources: