Find Debt Consolidation Loans Near Me

Get a Debt Consolidation loan today with Dime Alley and you can receive money upfront to cover emergency debt. We offer a completely online application with instant approval and options for bad credit scores and no credit checks. Simply click on the ‘Get Started’ button now to get your loan online!

What is a Debt Consolidation Loan?

A Debt Consolidation Loan merges unsecured debts, such as credit cards, medical bills, and payday loans, through leads to a single predictable monthly payment.

Selecting a debt consolidation loan is a smart choice if the interest rate on your loan is lower than the combined rates of your current debts. This not only ensures interest savings but also the potential for faster debt payoff.

Unlike juggling multiple credit card bills, you’ll have only one payment to worry about if you combine your debts under a debt consolidation loan.

What is the Eligibility Criteria to Apply for a Debt Consolidation Loan?

- Are over 18 years of age

- Have American citizenship

- Have a minimum monthly income of $800

- Have a current account for us to deposit funds into

How long does it take to get a Debt Consolidation Loan?

Dime Alley prioritizes quick and effective process, often granting approval and funds within a mere hour. It’s important to note that the funding process might extend up to 24 hours.

This slight delay is attributed to our commitment to securing the most fitting loan at optimal rates from our lenders. To ensure accuracy, they may reach out for income, credit score, and employment verification.

For quicker cash, we recommend submitting your application through Dime Alley on workdays between 9AM and 5PM. This enhances the likelihood of speedy processing.

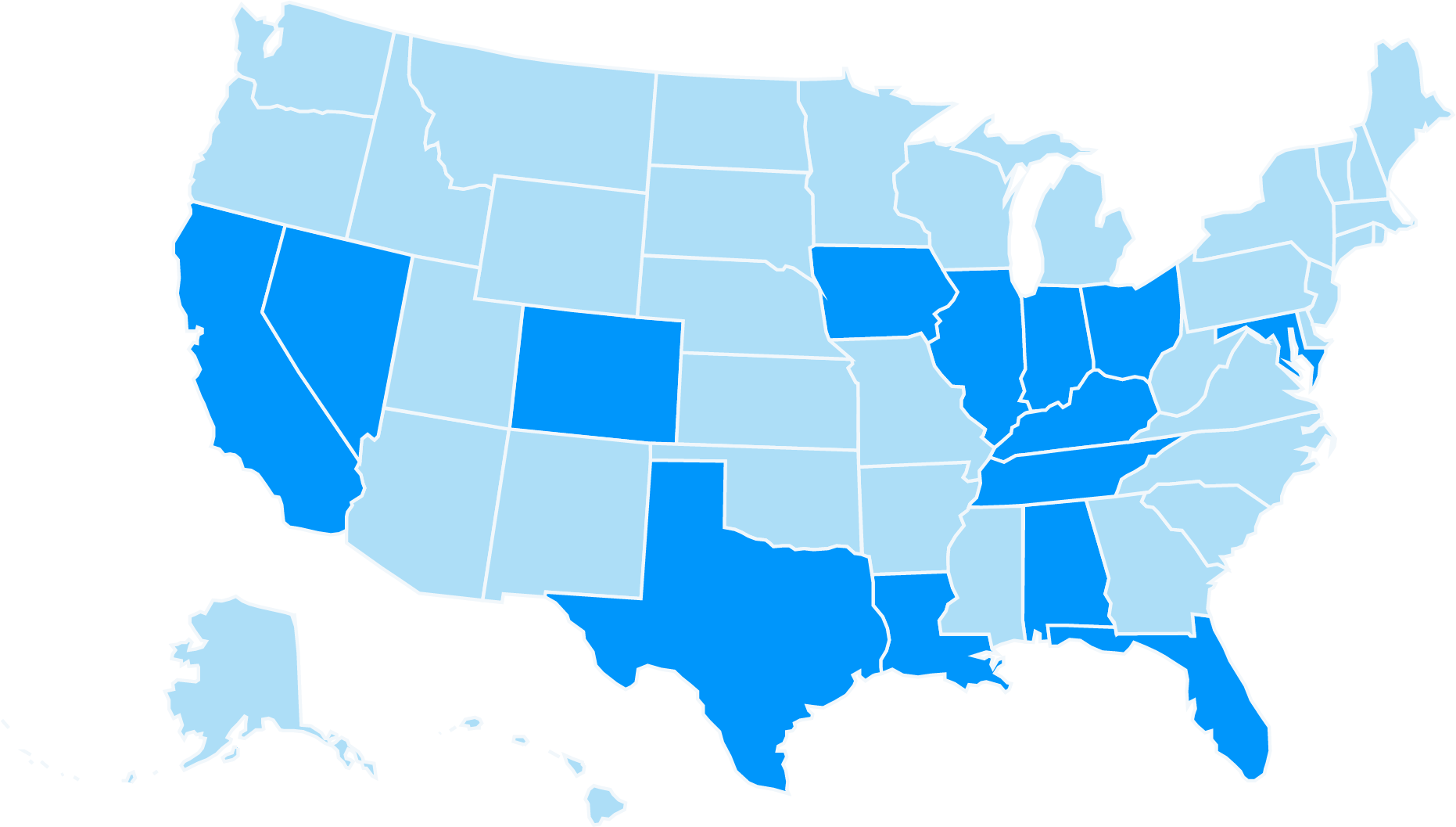

Where Can I

Get a Loan Near Me?

We proudly operate in the following US states:

We also operate

in Canada!

You can get a Debt Consolidation Loan in any Canadian province, including Ontario and Alberta – applying in Canada is just as easy as in the US.

Why Would I Need a Debt Consolidation Loan?

Getting a debt consolidation loan can be a strategic move for several reasons. If you’re grappling with multiple high-interest debts, consolidating them into a single manageable payment can alleviate financial stress. This step also enhances your credit score by showcasing responsible debt management.

- Simplified Finances: Managing numerous debts can be overwhelming. A consolidation loan streamlines your payments into one, making it easier to keep track of your finances.

- Lower Interest Rates: If the interest rate on the consolidation loan is lower than the average of your current debts, you’ll save money on interest payments over time.

- Single Monthly Payment: Instead of juggling various due dates, you make a single monthly payment which can relieve stresses and worries about multiple payments.

- Potential Debt Payoff Acceleration: With a lower interest rate, more of your payment goes toward the principal debt, potentially helping you pay off your debt faster.

- Improved Credit Score: Consistently making payments on time can enhance your credit score, reflecting positively on your financial stability.

- Avoid Collection Calls: Falling behind on payments can lead to collection calls. A consolidation loan helps you avoid such hassles.

Why Should I Get a Debt Consolidation Loan with Dime Alley?

When you need a debt consolidation loan, you may be pressed for time. Dime Alley’s quick and efficient approach to providing loans makes them the perfect broker to provide you with your loan.

Our application can be completed entirely online at any time, and it bears no hidden fees. Your application will take you less than 5 minutes to complete and you will see an instant decision on screen. Once a few further checks have been carried out, your cash advance will be deposited into your checking account within the next working day.

Dime Alley is reliable, as we only work with regulated lenders who protect their consumers. We offer other products payday loans in California and other states where they are legal such as Texas and Nevada. If you apply from other states, you will be offered a product with a price cap of 36% APR, such as personal or installment loans.

If you apply with us, we will match you with the lender best suited to you and your needs. This means that they will provide you with the best available terms.

Can I Get a Debt Consolidation Loan with Bad Credit?

Yes, we provide Debt Consolidation Loans for people with all credit backgrounds. Don’t worry if you have poor credit, we will help you secure a loan that suits your needs.

Our lenders provide funds for borrowers with poor credit – although it is worth bearing in mind that this may affect your repayment terms and the rates you’re offered.

How Can I Apply For a Debt Consolidation Loan with Dime Alley?

Click here today to begin our quick, easy and free application process for a debt consolidation loan.

You should only do this if you are confident that a cash advance is the right choice for you. If it is, then we would be delighted to become your lending partner. Fill out our quick and easy online application today to be one step closer to receiving the cash advance you need.

If you decide that applying for a loan with Dime Alley is right for you, you should proceed with our online application, which will take you less than five minutes to complete. You can fill it out at any time.

We will ask for a few details, such as your date of birth, how much you hope to borrow, how long for, and your employment status.

What People Say About Us

“After discovering Dime Alley via Google, I applied swiftly. An immediate decision led to same-day approval, enabling prompt car repair. I repaid the loan in two weeks, swiftly resolving my situation.”

Robert, Florida, July, 2021

“Had a positive encounter, received the loan within a day. Used it to consolidate my debt payments, open to future use if necessary. Thanks!”

Ian, Michigan, February 2023

“Approachable and friendly, Dime Alley followed through on their promises. Despite my poor credit, I secured a loan. The relief was brief but it greatly aided my family and me.”

Janice, Texas, September 2021

More Frequently Asked Questions

What is the Repayment Period on my Debt Consolidation Loan?

Customers can repay over 1 month to 60 months (or equal to 5 years) – this will depend on whether you prefer the payday option which may be just a few weeks or months, or the longer installment option which can be several years to stretch out your repayments.

Payments are usually made in equal monthly installments from the bank account you choose and you always have the option to repay early if you would like to do so.

Was this helpful?

How Much Can I Borrow in a Debt Consolidation Loan?

Cash Advance loans can range anywhere from $100 to $35,000, but are most commonly issued for amounts in the region of $100-$1,000.

We will do our best to provide you with a loan to pay-off all your debt, if possible!

Was this helpful?

Am I Charged a Fee for using Dime Alley?

No! We will never charge fees for using our service.

Instead, we take a fee or commission from the lender if your application is approved and successful. The lenders will charge a daily or monthly interest if your loan is active and this will be presented to you in writing before you proceed.

Was this helpful?

Will Applying affect my Credit Score?

No! Rest assured, the act of applying for a cash advance loan with Dime Alley will not have any impact on your credit, as we only initially carry out soft credit checks.

Was this helpful?

What's the Difference Between a Debt Consolidation Loan and Payday Loan?

To avoid any confusion, a payday loan is a loan to cover emergency short-term expenses, typically taken-out before you have paid these expenses.

A debt consolidation loan exists to help you to pay-off your debts with one payment, rather than having to worry about multiple debt payments.

Was this helpful?

Is Dime Alley a Broker?

Yes! Dime Alley is a broker, meaning that if you’re approved, we don’t provide the funds for your loan directly. Instead, we connect you to a lender best suited to your situation from our trusted panel.

Do not worry though, your information is completely secure and will not be sent or shared with any other companies or third parties and we certainly will not charge you anything for using our service.

Was this helpful?

Can I Get Debt Consolidation Loans in Canada?

Yes, our lenders operate across the 37 states where payday lending is legal in the United States, and all across Canada too!

No matter if you live in Toronto, Vancouver or Montreal, you can apply for a loan with Dime Alley today.

We consider borrowers with all sorts of credit histories, so don’t let a bad credit score stop you from applying online now!

Was this helpful?